AMC shares rebounded on Thursday, rallying more than 7%, though remained down 22% for the week.

Following another wild run for the Reddit darling, two traders joined CNBC's "Trading Nation" to answer whether the tide has turned back in the movie theater chain's favor.

Gradient Investments President Michael Binger gave his firm stance — this is a no-touch stock.

Get Boston local news, weather forecasts, lifestyle and entertainment stories to your inbox. Sign up for NBC Boston’s newsletters.

"I would not be a buyer for sure and if I owned it, I would sell it right here," he said Thursday. "I wouldn't be in any of these Reddit or meme stocks."

Binger highlights fierce competition as one negative against the company, arguing that AMC has been "under attack" by new players in the streaming and media landscape from platforms such as Disney+ and Peacock to streaming powerhouses like Netflix and Amazon.

In addition to the company's business model, he pointed out a fundamental issue AMC continues to face.

Money Report

"The company has not made money in the past three years and they're not forecasted to make money in the next three years," he said.

Binger also commented on the idea that the company has been opportunistic, saying it "looks to take advantage of any of these pops in the stock to dilute shareholders further so they could shore up their overleveraged balance sheets and their lack of cash flow."

"Bottom line, just stay away from this thing unless you're a purely speculative day trader," he said.

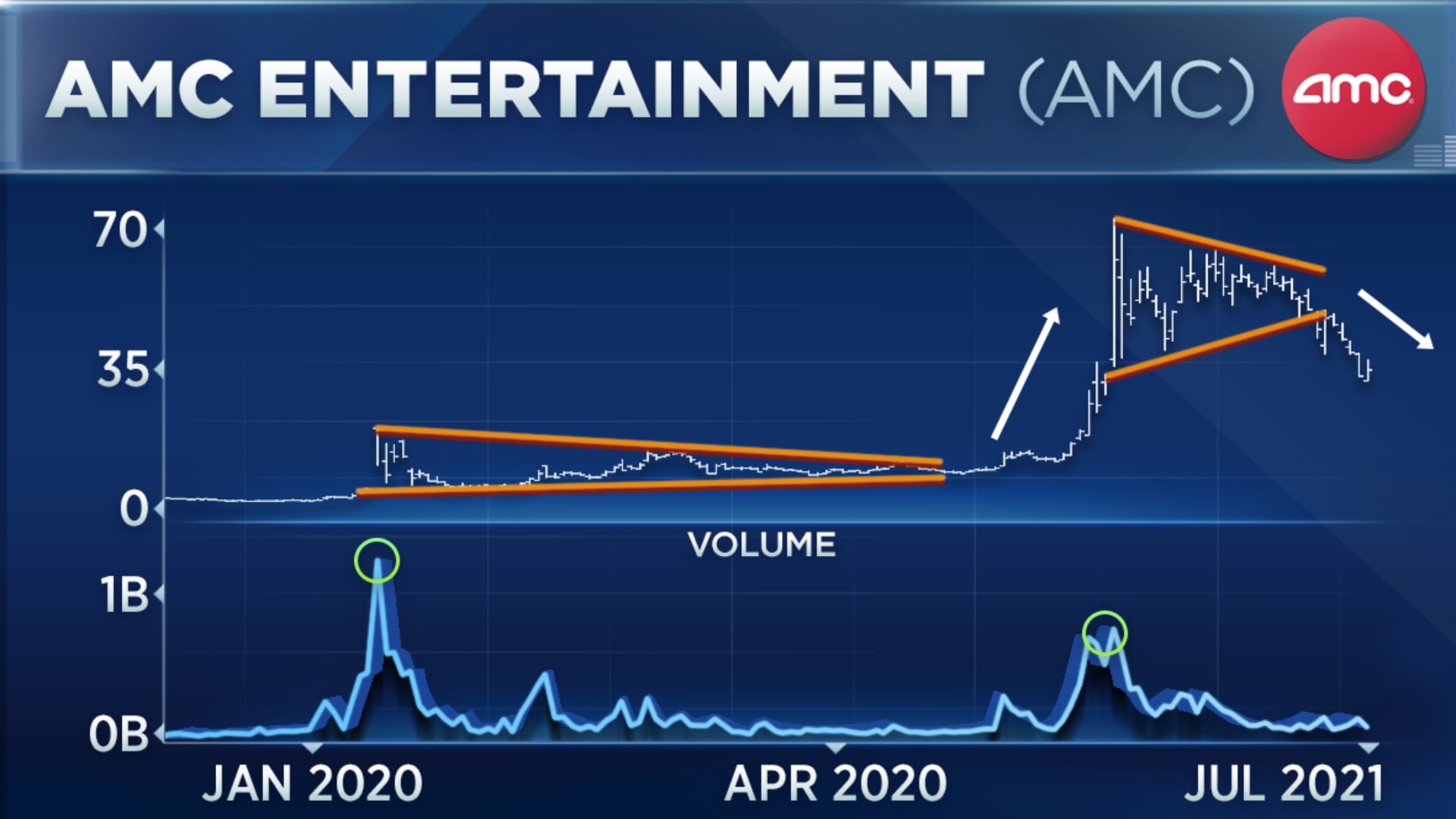

JC O'Hara, chief market technician at MKM Partners, charted the big moves the shares have seen this year as a way to identify the next potential move.

"This stock is not easy. I mean, this has been a wild ride for sure," he said Thursday.

O'Hara pointed out that the name consolidated earlier this year, which resulted in a monster breakout, pushing the share price from $10 to $70.

Since then, "we saw another round of consolidation, but what was different this time is we actually saw the stock break down," he said.

Considering AMC's recent price movement, O'Hara predicts the selling is not over at least for now.

"I still feel it's going lower," he said. "The last seller has not sold yet."

For signs of a bottom, O'Hara highlights the importance of watching trading volume. This could give an indication of when the next upswing could come.

"When we have major fear and greed and supply and demand imbalances in the market, you will get a pretty darn good picture at tops and bottoms from spikes in volume," he said. "So, I still think we're going lower. My gut says we need to see another round of strong volume, and that to me, will signal the end of the downside."

Disclosure: Peacock is the streaming service of NBCUniversal, parent company of CNBC.