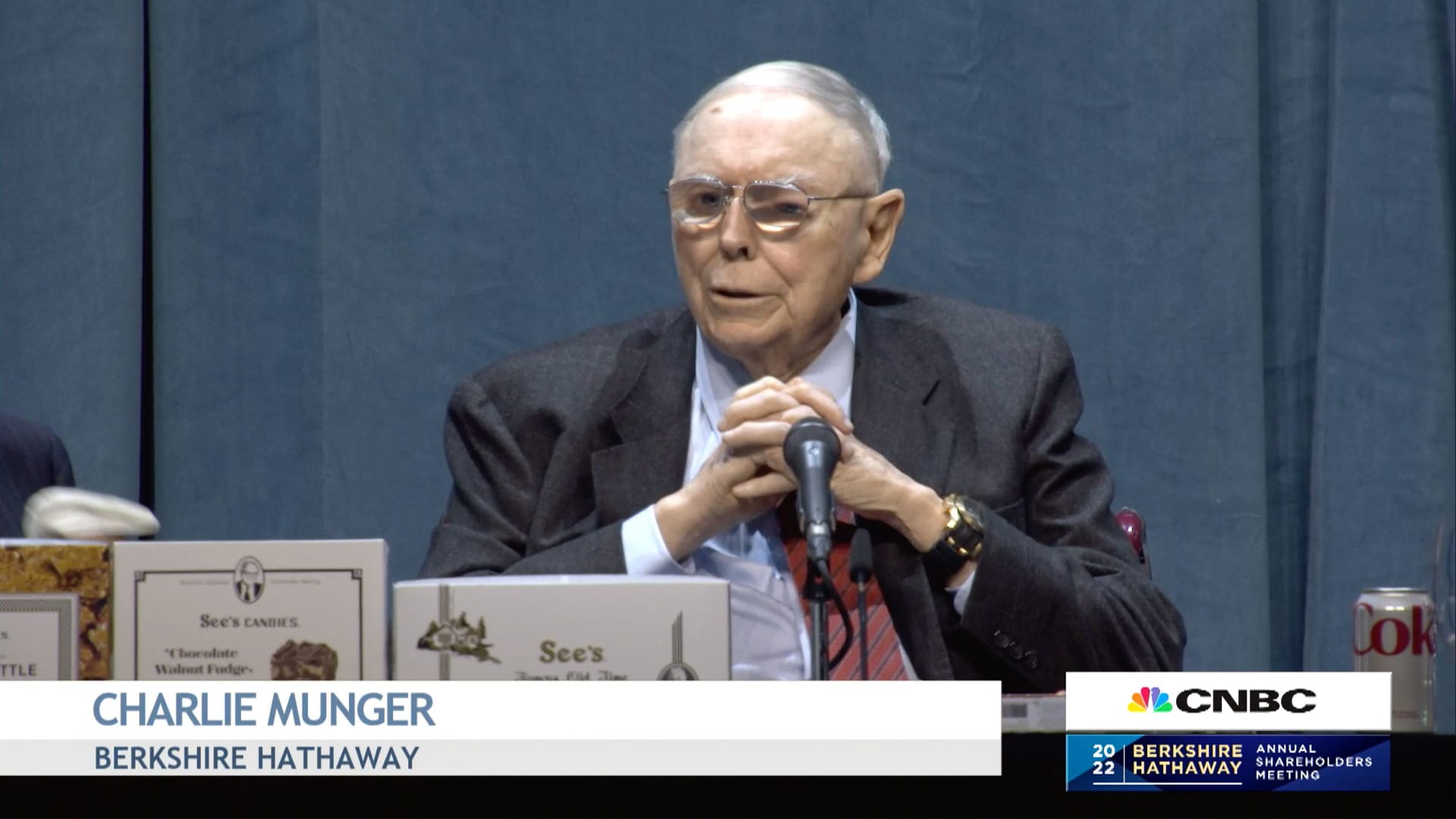

Berkshire Hathaway Vice Chairman Charlie Munger blasted stock trading app Robinhood on Saturday, saying the company is now "unraveling."

"It's so easy to overdo a good idea. ... Look what happened to Robinhood from its peak to its trough. Wasn't that pretty obvious that something like that was going to happen?" Munger said at Berkshire Hathaway's annual shareholder meeting Saturday.

Munger lambasted what he characterized as Robinhood's "short-term gambling and big commissions and hidden kickbacks and so on."

Get Boston local news, weather forecasts, lifestyle and entertainment stories to your inbox. Sign up for NBC Boston’s newsletters.

Robinhood does not charge users commission and generates a majority of its revenue from "payment for order flow," the back-end payment brokerages receive for directing clients' trades to market makers.

"It was disgusting," Munger said. "Now it's unraveling. God is getting just."

Robinhood went public last July and shares are down 88% from their August 2021 high.

Money Report

The company rose to prominence during the pandemic and played a key role in some massive short squeezes last year, as retail investors flocked to the app to push meme stock prices higher and inflict pain on short sellers betting against the stocks.

Munger in February 2021 amid a wild trading rush first criticized Robinhood for its practices, calling the app's business model a "dirty way of making money."

The company on Thursday reported a decrease in users and a wider-than-expected loss for the first quarter. Earlier in the week, Robinhood announced it would cut about 9% of full-time employees.

Robinhood responded to Munger's comments, saying the vice chairman does not understand the trading platform.

"It is tiresome witnessing Mr. Munger mischaracterize a platform and customer base he knows nothing about. ... He should just say what he really means: unless you look, think, and act like him, you cannot and should not be an investor. We're happy to share our educational tools, as it also seems he is lost on digital currencies," Jacqueline Ortiz Ramsay, Robinhood head of public policy communications, said in an email to CNBC.

Munger's remarks echoed comments from Berkshire Chairman and CEO Warren Buffett earlier in the meeting ripping on Wall Street for turning the stock market into a "gambling parlor."

"Is it wise to criticize people at all?" Buffett asked.

"Probably not, but I can't help it," Munger said.

Check out all of the CNBC Berkshire Hathaway annual meeting coverage here.