- CNBC's Jim Cramer on Friday looked ahead to next week's key market events after the S&P 500 notched its seventh consecutive day of gains.

- "We need to see if this rosy action can hold up through next week, a period that historically tends to produce some ugly sell-offs," the "Mad Money" host said.

- "If the earnings stay strong, well, I think the stock market can stay strong, too," he said.

CNBC's Jim Cramer on Friday looked ahead to next week's key market events after the S&P 500 notched its seventh consecutive day of gains to close at a record-high 4,697.53.

"We need to see if this rosy action can hold up through next week, a period that historically tends to produce some ugly sell-offs. ... But if the earnings stay strong, well, I think the stock market can stay strong, too," Cramer said.

Get Boston local news, weather forecasts, lifestyle and entertainment stories to your inbox. Sign up for NBC Boston’s newsletters.

Here's what the "Mad Money" host will be keeping his eyes on. All revenue and earnings per share estimates are from FactSet.

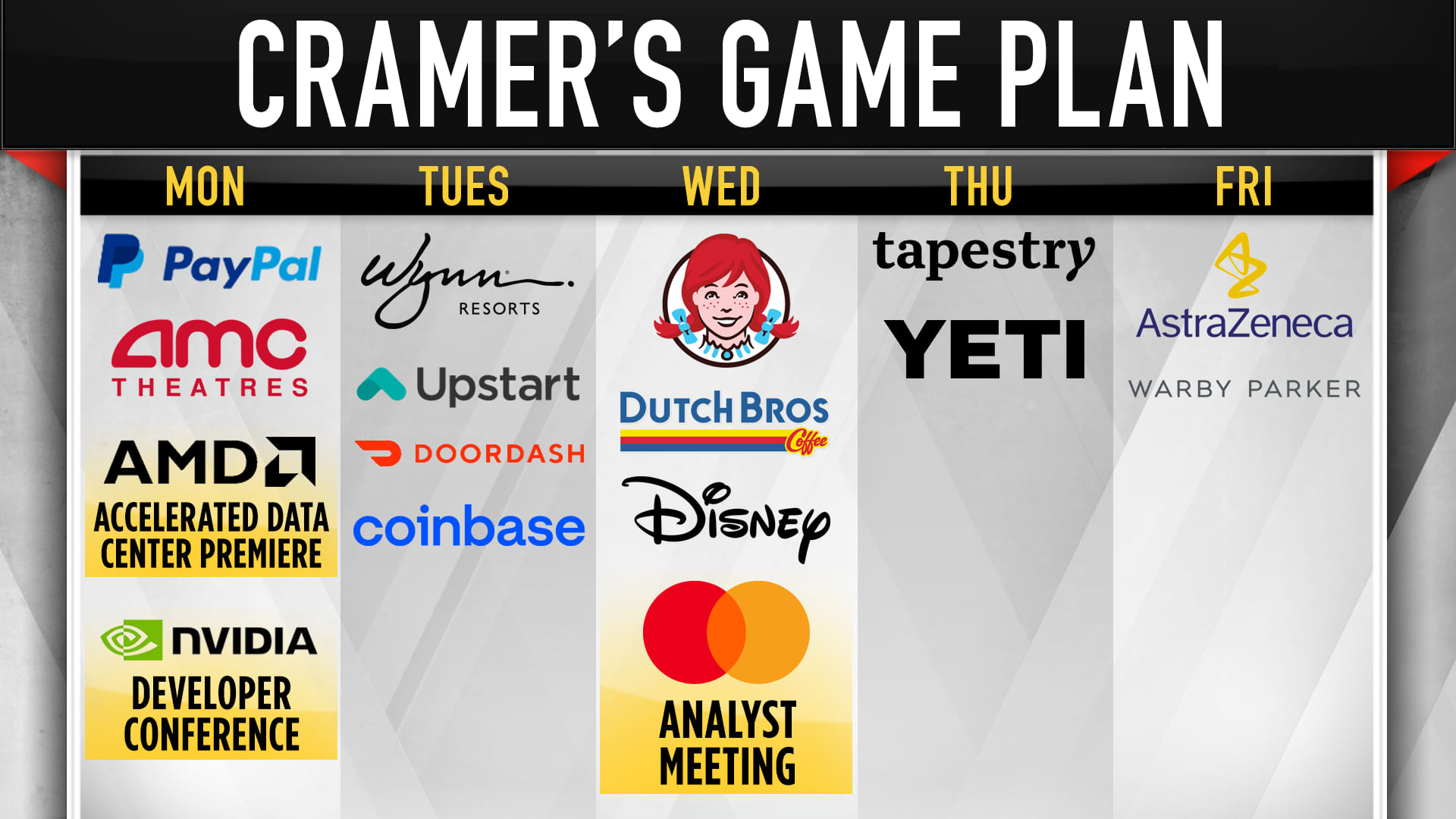

Monday: Earnings from PayPal and AMC Entertainment; events from AMD and Nvidia

- Q3 earnings after the bell; conference call at 5 p.m. ET Monday

- Projected EPS: $1.07

- Projected revenue: $6.23 billion

Cramer said owning PayPal for his charitable trust has so far been "a disaster," as the stock has been crushed recently. "Dan Schulman, the CEO, already warned us that this would be a tough quarter because of PayPal's final separation from eBay, but it's already down more than 80 points, which to me seems overdone," Cramer said.

- Q3 results after the close; conference call at 5 p.m. ET Monday

- Projected EPS: loss of 53 cents

- Projected revenue: $708 million

It's hard to value AMC now that it's a meme stock with a very passionate group of retail investors who own it, Cramer said. "I bet CEO Adam Aron will do a great job on the call, and the individual investors will buy even more, so the stock will hang in because he knows how to give his shareholder base what it wants," he said.

- Accelerated data center premiere 11 a.m. ET Monday

Cramer said he expects AMD CEO Lisa Su to tell a great story at Monday's event. "I think AMD is well on its way to eclipsing Intel in market capitalization. ... How the mighty have fallen," he said.

- The semiconductor company's annual GPU Technology Conference on Monday through Thursday

"Be prepared to be dazzled," Cramer said.

Money Report

Tuesday: Wynn Resorts, Upstart Holdings, Coinbase and DoorDash

- Q3 results after the bell; conference call at 4:30 p.m. ET Tuesday

- Projected EPS: Loss of $1.36

- Projected revenue: $943 million

Cramer said he's in Wynn Resorts for the long haul, believing the "stock will soar" once business in the gaming hub of Macau picks up in earnest. "Until then, pain," he said.

- Q3 results after the close; conference call at 4:30 p.m. ET Tuesday

- Projected EPS: 33 cents

- Projected revenue: $214.9 million

The fintech firm uses artificial intelligence to modernize the lending process.

- Q3 results after the bell; conference call at 5:30 p.m. ET Tuesday

- Projected EPS: $1.73

- Projected revenue: $1.57 billion

"The action in cryptocurrency has been pretty exciting of late, so that should send Coinbase higher even though it's been going up. That said, they need to drop the arrogance. They've got to get into chill mode," Cramer said.

- Q3 results after the close; conference call at 5 p.m. ET Tuesday

- Projected EPS: Loss of 10 cents

- Projected revenue: $9.96 billion

The strength of Uber's food-delivery business in the third quarter may be a harbinger of strong results from DoorDash, Cramer said, suggesting the company could "blow the doors off."

Wednesday: Wendy's, Dutch Bros, Walt Disney Co., and Mastercard meeting

- Q3 results before the bell; conference call at 8:30 a.m. ET Wednesday

- Projected EPS: 18 cents

- Projected revenue: $471 million

Cramer said he hopes Wendy's, which he described as his favorite quick-serve restaurant chain, can report numbers that were as good as McDonald's latest results.

- Q3 results after the close; conference call at 5 p.m. ET Wednesday

- Projected EPS: 6 cents

- Projected revenue: $125.2 million

The Oregon-based chain has proved to be one of the hottest initial public offerings of the year, Cramer said. "This is a terrific regional to national growth story," he said, but suggested he still has some valuation concerns about the stock.

- Q4 results; conference call at 4:30 p.m. ET Wednesday

- Projected EPS: 52 cents

- Projected revenue: $18.8 billion

Cramer said Disney's report may be "rough." He noted some of its theme parks haven't been at full capacity, and its slate of movies is "good, not great." Meanwhile, its flagship streaming service, Disney+, also "seems to be slowing," he said.

- Investor meeting kicks off at 8:30 a.m. ET Wednesday

While the company's stock has been crushed lately, Cramer said it's important to remember Mastercard benefits from consumer spending and, crucially now, the resumption of cross-border travel.

Thursday: Tapestry and Yeti

- Q1 fiscal 2022 results before the bell; conference call at 8 a.m. ET Thursday

- Projected EPS: 70 cents

- Projected revenue: $1.44 billion

Cramer said any positive news from the parent company of Coach and Kate Spade should help push the stock to a new 52-week high above $49.66 per share. The stock closed Friday at $42.51.

- Q3 earnings before the open; conference call at 8 a.m. ET Thursday

- Projected EPS: 60 cents

- Projected revenue: $358 million

Cramer said he believes the company, known for its insulated mugs and coolers, is more than a pandemic winner.

Friday: AstraZeneca and Warby Parker

- Q3 earnings before the bell; conference call at 7:45 a.m. ET Friday

- Projected EPS: £92.54

- Projected revenue: £7.04 billion

Of the companies that have developed Covid vaccines, Cramer said he believes "there are better fish to fry" than AstraZeneca.

- Q3 results before the open; conference call at 8 a.m. ET Friday

- CNBC

- Projected revenue: $133.1 million

Cramer said he's eager to learn more about Warby Parker in the glasses maker's first quarterly results as a public company.

CORRECTION: This article has been updated to correct an erroneous comment about Wells Fargo recently hiring fintech firm Upstart. It has not.

Sign up here for the new CNBC Investing Club newsletter to follow Jim Cramer's every move in the market, delivered directly in your inbox.

Disclaimer

Questions for Cramer?

Call Cramer: 1-800-743-CNBC

Want to take a deep dive into Cramer's world? Hit him up!

Mad Money Twitter - Jim Cramer Twitter - Facebook - Instagram

Questions, comments, suggestions for the "Mad Money" website? madcap@cnbc.com