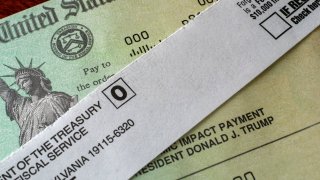

With tax season approaching, those who have not received their stimulus payments or think the IRS deposited the wrong amount can finally take action to get the money they're owed.

The IRS has already distributed the vast majority of economic impact payments to households without issue. But some people either fell through the cracks or received the wrong amounts. Those people can claim their missing money on their 2020 tax returns.

If you believe you're owed money from the IRS, here's what to know about stimulus payments and your taxes.

When can I file?

The tax season was pushed back a few weeks to Feb. 12 this year to give the agency time to program systems to reflect tax law changes implemented late in 2020, including the second round of stimulus checks.

Tax preparation companies are already accepting returns. Assuming you have all the paperwork you need, you can prepare your return now to be filed on Feb. 12. And remember: If your income was $72,000 or less in 2020, you can use the IRS's Free File Program to file your federal return for free.

How do I claim the payments on my taxes?

Money Report

You won't see "stimulus checks" or "economic impact payment" on your return. To get the money you're owed, look for the Recovery Rebate Credit. This will be on line 30 of your 2020 Form 1040 or 1040-SR.

On this line, you will list the difference between what you are owed and what you received (you can find the amount the IRS paid you in your IRS.gov account). Then, either your refund will increase or the amount you owe the IRS will decrease.

This also applies to people who normally don't file taxes because they don't earn enough money.

How much should I have received?

The first economic impact payment was worth $1,200 per adult earning up to $75,000 in 2019 ($2,400 for couples earning up to $150,000) and $500 per child under age 17. The second was valued at $600 per adult earning up to $75,000 ($1,200 for couples earning up to $150,000) and $600 per child. After those income limits, the payments phase out.

There are many calculators you can use to estimate how much money you should have received total. Additionally, the IRS is including a Recovery Rebate Credit Worksheet in the instructions for Form 1040.

If you received the proper payment amounts for each check, then you don't need to do anything on your tax return.

What if my income or household size changed from 2019 to 2020?

The payments were based off 2019 income (and in some cases 2018) and household size. If your income and/or household size changed in 2020, then you might qualify for more money. (If you received a payment but your income increased from 2019 to 2020, you won't owe any of the money back to the IRS.)

Here's an example: A single person made $150,000 in 2019, but lost her job at some point in 2020 and only made $50,000 for the year. She wouldn't have qualified initially for either payment, but can now claim the full amount on her 2020 tax return, and expect a total of $1,800. This also applies to people who received a partial payment, but their income fell enough in 2020 that they became eligible for the full $1,200 and $600.

Another situation in which a taxpayer may be owed money is if, for example, he had one child in 2019, and then another in 2020. He only received payments for one of the dependents, but can claim the second on his tax return now and expect to receive $1,100.

Finally, many low-income individuals who do not normally file taxes may not have gotten their payments. While they can file a return in 2020, President Joe Biden has directed the Treasury Department to take additional measures to finally deliver payments to anyone who has not received them yet.

I was claimed as a dependent on someone else's 2019 return, but was on my own in 2020. Do I get a payment?

The short answer is: Yes. If you were a dependent on someone else's tax return in 2019, but were not in 2020, then you can claim the payments on your own return this year. Assuming you meet the income limits and don't have dependents of your own, you can expect $1,800.

However, adult dependents age 17 and older do not qualify for either payment and cannot claim them. This includes many college students, disabled Americans and elderly dependents.

Finally, eligible mixed-status families — in which some members have Social Security numbers but others, typically one or both parents, do not — that did not receive the first payment can claim it on their 2020 return. These taxpayers were initially ineligible to receive checks under the CARES Act, but were included in the second round and can now claim the first payment.

This article was updated to clarify who qualifies as a dependent.

Check out:

- Biden signs executive orders to increase food stamps benefits and send missing stimulus checks

- $1,400 checks, enhanced unemployment: Here's what's included in Biden's stimulus plan

Don't miss: The best credit cards for building credit of 2021