Many American parents are financially supporting their adult children at the expense of their own financial wellness.

Almost half, or 45%, of parents with adult offspring have given their children money during the coronavirus pandemic and of those 79% said the funds would have otherwise gone towards their own personal finances, a survey from CreditCards.com found.

It wasn't just chump change, either. Those with an annual household income of less than $40,000 gave an average of $1,403, while those with a household income of $40,000 to $80,000 gave $2,170 on average. Parents who had an annual household income of more than $80,000 gave their kids an average $8,530.

"This is holding them back from paying off their own credit card debt," said Ted Rossman, senior industry analyst at CreditCards.com. "It is impacting their ability to save for the future."

Get Boston local news, weather forecasts, lifestyle and entertainment stories to your inbox. Sign up for NBC Boston’s newsletters.

In fact, parents who gave money that would have normally been used for their own finances said they would have otherwise used the money to pay down their own debt, for day-to-day expenses and to boost their emergency savings, as well as put money towards retirement.

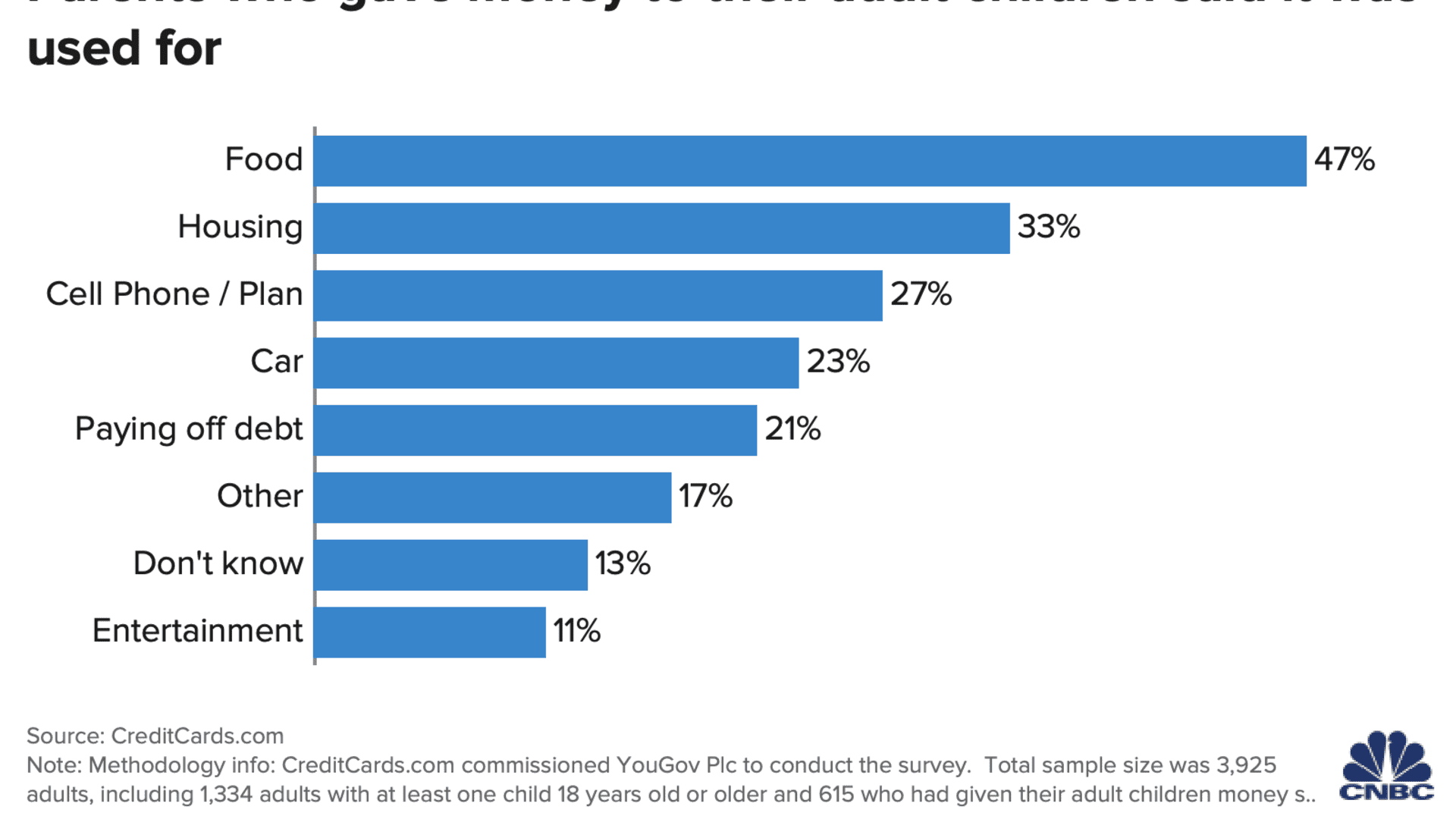

Most of the money parents gave their children was used for food and housing, and also included a cell phone or wireless plan, a car, paying off debt and entertainment.

It's only natural that parents want to help their children, especially during a pandemic, said certified financial planner Lawrence Sprung, president of Hauppauge, New York-based Mitlin Financial. However, they should be careful about setting a precedent, especially with your younger adult kids.

Money Report

"We want to ultimately help our children to become self-sustaining members of society and not rely on mom and dad every time they make a misstep," Sprung said.

More from Invest in You:

Cooperman: 3 things wealthy people shouldn't do and 1 thing they should

8 books that will change the way you think about money and life

To get a low mortgage rate, your credit score matters. Here's how to boost it

He suggests having an agreement, particularly with older adult children, on how the help will be repaid. Also include some educational guidance so your children can prepare themselves for the future and avoid finding themselves in a similar position again, he said.

However, a loan may not always be the wisest idea, Rossman said. He suggests making it a gift, if you can afford it, to avoid damaging your relationship in the future.

A 2019 Bankrate survey found that of the 60% of Americans who lent a loved one cash, 46% lost money and/or saw their relationship with the borrower harmed.

"It would be a sad outcome if your relationship was hurt over this," Rossman said.

Most important, make sure you don't hinder your ability to retire or reach your own goals, Sprung said.

"Financial wellness is something that needs to be planned for and monitored, ultimately your children need to learn this, too," he said.

SIGN UP: Money 101 is an 8-week learning course to financial freedom, delivered weekly to your inbox.

CHECK OUT: We paid off $250,000 in debt and grew our net worth to $800,000: Here's our best advice via Grow with Acorns+CNBC via Grow with Acorns+CNBC.

Disclosure: NBCUniversal and Comcast Ventures are investors in Acorns.