U.S. Treasury yields climbed on Thursday, with the benchmark 10-year rate breaching the 2% level, after key inflation data showed hotter-than-expected price pressures.

The yield on the 10-year Treasury note jumped 12 basis points to about 2.05%, the first time that the benchmark rate reached 2% since August 2019. Yields move inversely to prices and 1 basis point is equal to 0.01%.

The yield on the 2-year Treasury bond, the most sensitive duration to interest rates, surged 26 basis points to top 1.6%. The surge marked the 2-year's biggest single day move since 2009.

Get Boston local news, weather forecasts, lifestyle and entertainment stories to your inbox. Sign up for NBC Boston’s newsletters.

The consumer price index, which measures the costs of dozens of everyday consumer goods, rose 7.5% compared to a year ago, the Labor Department reported Thursday.

That compared to Dow Jones estimates of 7.2% for the closely watched inflation gauge. It was the highest reading since February 1982.

"Inflation is not backing off," said Michael Schumacher, Wells Fargo's director of rates strategy. "People are really spooked. Look at the two-year Treasury. It's a pretty easy bellwether... I wouldn't say it's unglued but it's certainly pricing in a ton from the Fed."

Money Report

Yields pushed higher in afternoon trading after St. Louis Fed President James Bullard told Bloomberg News that he was open to a 50-basis point hike in March and wanted to see a full percentage point of hikes by July.

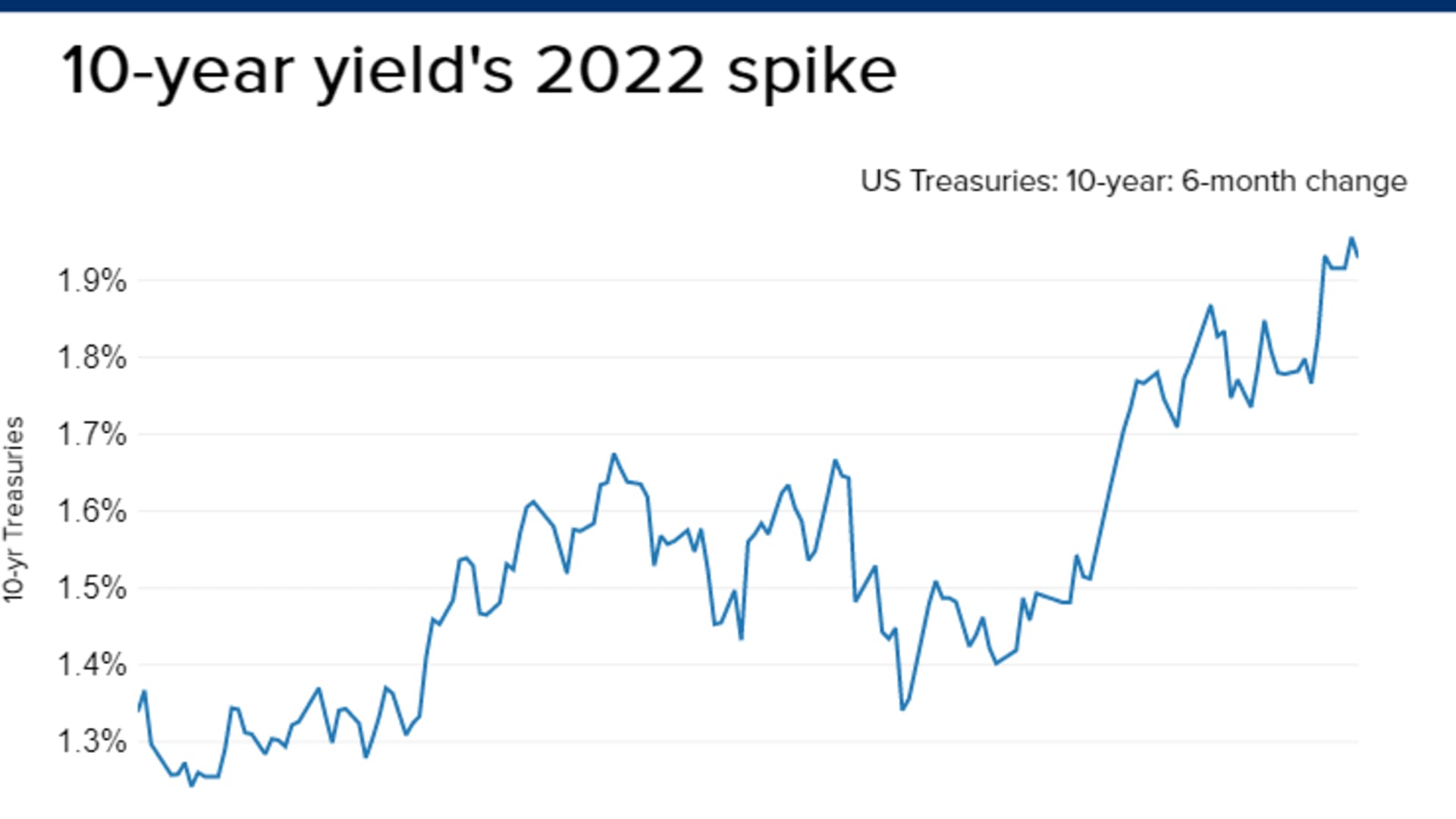

The benchmark Treasury yield has spiked a great amount in 2022, rising almost 50 basis points from 1.51% at the end of last year. In February alone, the 10-year rate has gained about 20 basis points from where it ended January around 1.78%.

Rapidly rising inflation and Bullard's comments have pushed traders to price in a faster pace of Fed interest rate hikes.

Futures trading as gauged by the CME pointed to a near-100% chance of a 50-basis-point increase at the March meeting. The market also is anticipating a 61% chance that the Fed will hike seven times this year, which would entail a move at every meeting through the end of 2022.

"CPI inflation fire burns hotter and the Fed will need a bigger firehose," Chris Rupkey, chief economist of FWDBONDS. "Inflation is raging out of control due to too strong consumer demand and the only thing the Federal Reserve can do is rein in consumer spending."

Separately, initial jobless claims came in at 223,000 for the week ended Feb. 5. The number is lower than a Dow Jones estimate of 230,000.

Auctions are scheduled to be held for $50 billion of 4-week bills, $40 billion of 8-week bills and $23 billion of 30-year bonds.

— CNBC's Patti Domm and Jeff Cox contributed reporting.