- Economic data has shown during this inflationary period that while nominal wages are higher American workers are not experiencing real wage gains.

- A new CNBC|Momentive national survey of workers shows that two-thirds say their pay isn't keeping up with higher prices.

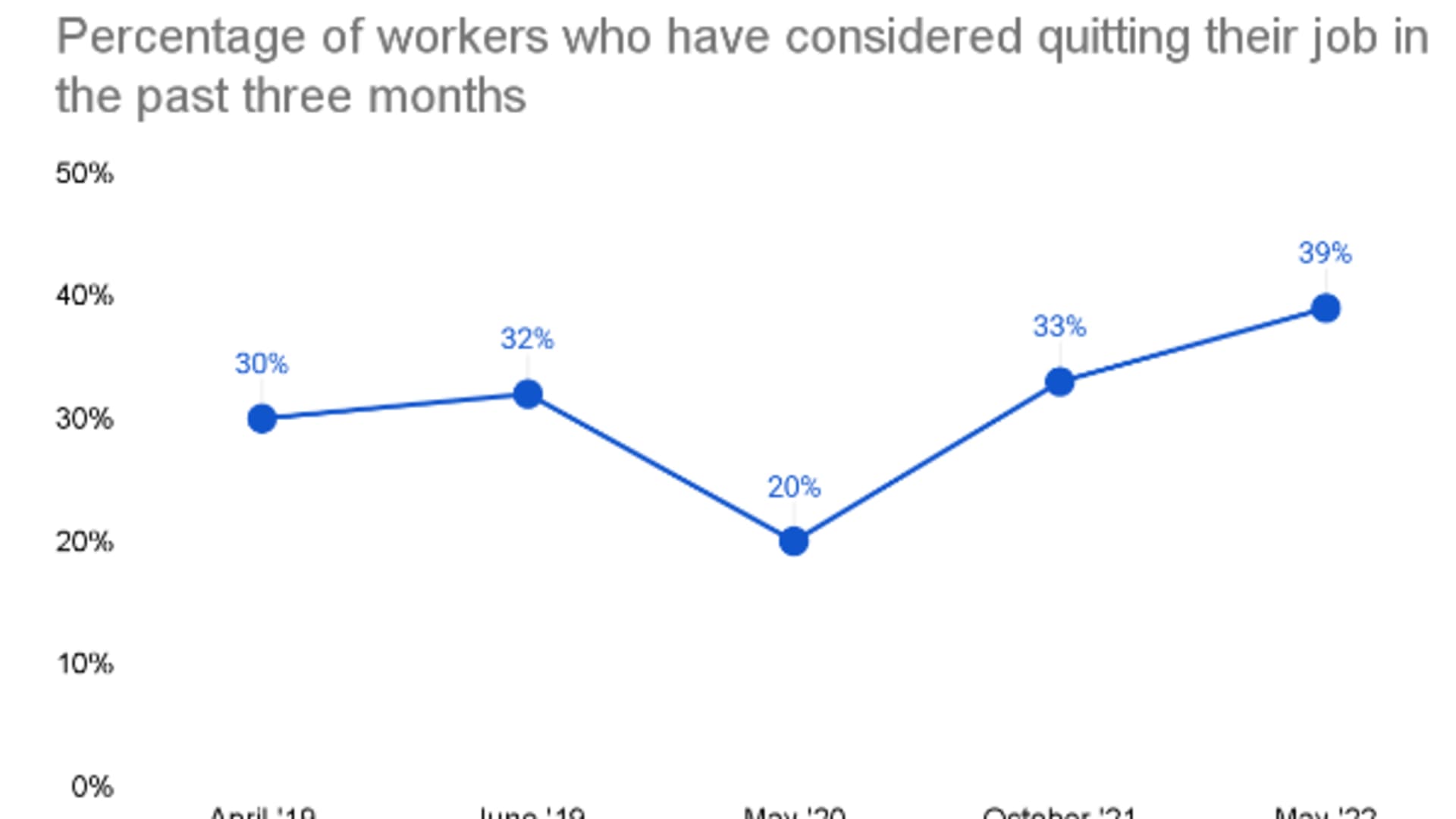

- Middle-income Americans are now the most squeezed, according to the survey, and the percentage of workers thinking about quitting is at a four-year high.

The latest inflation read from the government, the core personal consumption expenditures price index, showed on Friday morning that prices may be starting to ease from record levels, but financial stress among workers amid the steepest inflation in four decades remains as high as ever.

Two-thirds of American workers say their salaries are not keeping pace with inflation, and the percentage of employees considering quitting a job is at a four-year high, according to a new CNBC|Momentive Workforce Survey.

Sixty-six percent of workers say inflation has outpaced any salary gains they've made in the past 12 months, while 19% say increases in their salary have about matched inflation and 13% say their salary has increased more than inflation.

Get Boston local news, weather forecasts, lifestyle and entertainment stories to your inbox. Sign up for NBC Boston’s newsletters.

As more American workers at multiple income levels give voice to a frustration that the economic data has been signaling throughout this year — that price gains continue to outpace wage gains — the squeeze is particularly high among middle-income workers. Those with incomes between $50,000 to $150,000 are more likely than high-income and low-income groups to say their salary has not kept up with inflation, according to the survey.

The online poll was conducted May 10-16, 2022 among a national sample of 9,254 workers in the United States.

While 72% of workers in the CNBC|Momentive poll say they are "well paid" or "very well paid," that is tied for the lowest level in the survey's history, while the 28% who say they are not well paid is at an all-time high.

Thirty-nine percent of workers say they have seriously considered quitting their jobs in the past three months, the highest level since the survey began in 2019, and up 6% from last November.

"Inflation is absolutely a driver in worker turnover right now," said Laura Wronski, senior manager of research science at Momentive. "Workers who say their salary has outpaced inflation are the least likely to say they've considered quitting their job in the last three months, and workers who say inflation has outpaced their salary increases are the most likely to be looking for a new job."

Money Report

The latest inflation reading spurred hopes peak inflation may have been passed, but an easing in prices doesn't mean high inflation is going away.

Real wage growth across the wage distribution is down, and it is the middle-income workers that are in a worse position than they were pre-pandemic — the lowest-wage workers, by contrast, while struggling with inflation have seen the biggest wage gains. "They are getting hit really hard by this," said Heidi Shierholz, president of the Economic Policy Institute, which focuses on the needs of low- and middle-income Americans.

As companies including Microsoft and Apple announce pay raises for workers this month, among both the salaried class, and in Apple's case, workers in its retail stores where the first unionization drives are underway, Shierholz said workers are aware of one important data point that frustrates them and is pressing them to demand more: corporate profit increases.

"We know a huge part of the rise in prices has been because employers' profits have gone way up," she said. "Workers are paying the higher prices and their employers are raking in the profits, and that's just a fundamental imbalance. There is capacity to go higher. There is a choice. These gains are going to profits and employers could make a different choice," she said.

Quit rates are elevated across the wage distribution, but record level of workers thinking about quitting doesn't directly overlap with the middle-wage worker squeeze, because the highest level of quits is among the lower-wage jobs where the highest level of openings exist.

"Low-wage workers are able to job hop, finding new opportunities at higher wage levels. Really high-income workers, those making $150,000 or more per year, are more likely to be in jobs that have been able to boost salaries by the most, so even if they've stayed in their role they've seen their salaries grow," Wronski said.

The quit rates in the Covid economy show the biggest spikes in low-wage sectors including retail and food services, not knowledge worker jobs more concentrated in the middle-income bracket.

"People were expecting a lot more workers to jump ship when the big raises didn't come, and they didn't," said Rucha Vankudre, senior economist at labor market research firm Emsi Burning Glass.

Now is the time to get your wage gains

Now may be the time to press for more from employers because the level of wage gains and job openings in the current market aren't sustainable. Quit rates will go down and the intense competition for workers the labor economy is witnessing will soften as overall employment continues to rise.

"As we get closer and closer to full employment, the job growth will slow and the job openings will slow," Shierholz said.

And as Covid moves farther into the rearview mirror, more workers will come back.

"That's not good for workers," she said. "We are in this extraordinary moment of increased worker bargaining power because of some extraordinary circumstances of the Covid recovery. Those won't last."

An economy that is adding 500,000-plus jobs a month and as many over the first four months of this year as in most complete years over the past decade cannot continue at that pace, and this means the ability to move jobs and receive higher wage increases because of the high competition for workers will decline.

There will be a lasting awareness among workers that they can join together and demand more of employers, whether it is pay or benefits or company values. "That awareness won't just go away," Shierholz said.

The recent pay increases from Microsoft and Apple are a recognition of the increased power of workers from companies with the biggest profit levels in the market. But an inflationary truth that will remain is that a $22 per-hour wage for a worker in an Apple retail store is a lot less three years from now. "These wage gains won't be reduced, but we are still going to have inflation. It is a constant thing. It's not like now that we've gotten these wage increases, it's mission accomplished. There is still so far to go," Shierholz said.

With two job openings for every worker, power remains tilted to the worker, and economists say it is difficult to envision a situation in which employers get back all the power that has shifted in recent years.

"We just don't have the people to fill those jobs and employers will have to give a little. We have never been here before, never had this many job openings," Vankudre said.

Employers have already become more flexible on conditions like hybrid work, and in terms of benefits and training being offered, but pay is not keeping pace with inflation in real terms.

"There was an expectation that everyone [employers] would make market adjustments and that didn't really happen," Vankudre said.

Meanwhile, the clock is ticking on a record job recovery.

"Now is the time to get your wage gains if you can," Shierholz said.