The partial government shutdown has some small businesses in limbo as they wait for the federal loans they need to open or expand.

Pancho’s Taqueria in Dedham, Massachusetts is one of the businesses affected.

Owners Carlos Chavira and Nohely Chavira-Williams are siblings and opened the restaurant with the dream of bringing the food they grew up with in Mexico to Massachusetts.

After doing so well over the last three years on High Street, they decided to expand and open a second location in Needham.

They have the space and the permits, but there is no one to process their loan application due to the Small Business Administration being closed during the shutdown.

“It’s so frustrating because we just want to do what we do and we can’t,” Chavira said. “People want to know when we’re going to open and we can’t answer.”

The Chaviras are not alone. According to a press release before the shutdown, the Small Business Administration helped borrowers in Massachusetts get more than $500 million during the last fiscal year.

Local

In-depth news coverage of the Greater Boston Area.

During the shutdown, borrowers across the country are waiting.

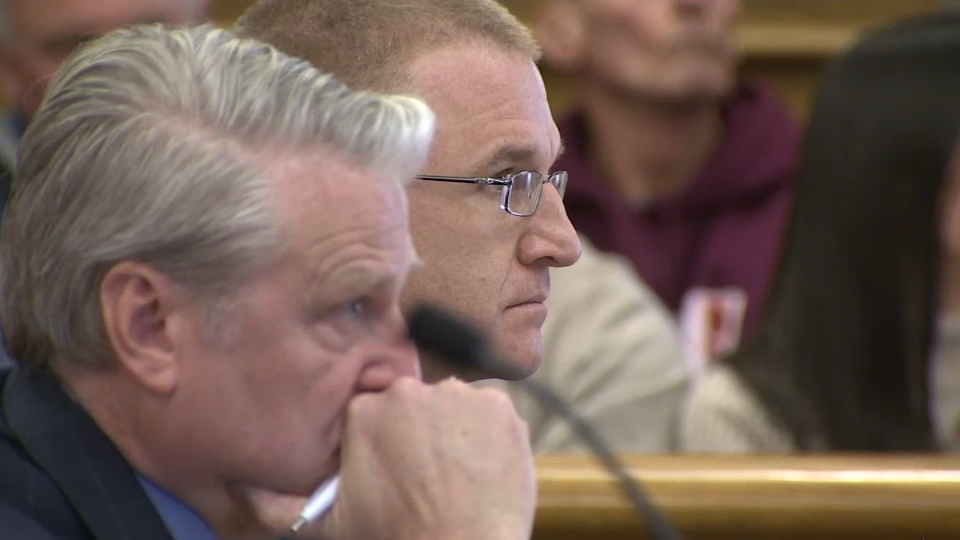

Richard Cheney, who works for the Small Business Development Center in Worcester, Massachusetts said his clients are already worried. The office is advising them the best they can, but he said beyond asking landlords and contractors if they can get paid later, there is not much a business owner can do.

“This is uncharted territory,” Cheney said. “Other than wait and see or just wait, we try to give them options, but we don’t know of options right now. It delays everybody.”

At Pancho's, they said they are losing time and resources while they wait for a loan between $150,000 and $200,000. With the rent on their Highland Avenue location in Needham due soon, they said they will have no choice but to dip into their savings.

“Things are going to get tough,” Chavira said.