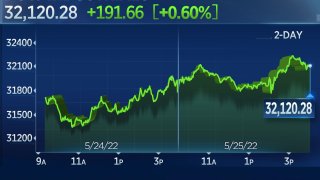

Stocks Rise After Fed Signals Further Rate Hikes, Dow Jumps Nearly 200 Points

Stocks rose on Wednesday after the minutes of the Federal Reserve's May policy meeting showed the central bank is prepared to raise rates further than the market had anticipated.

The Dow Jones Industrial Average jumped 191.66 points, or 0.6%, to 32,120.28. The S&P 500 climbed 0.9% to 3,978.73, and the Nasdaq Composite advanced 1.5% to 11,434.74. All of the major averages are currently on pace for a winning week.

The minutes from the Fed's May 3-4 meeting showed officials saw the need to raise rates quickly, and possibly more than the market has priced in, to quell the recent inflationary pressures.

Get Boston local news, weather forecasts, lifestyle and entertainment stories to your inbox. Sign up for NBC Boston’s newsletters.

"Most participants judged that 50 basis point increases in the target range would likely be appropriate at the next couple of meetings," the minutes stated. In addition, Federal Open Market Committee members indicated that "a restrictive stance of policy may well become appropriate depending on the evolving economic outlook and the risks to the outlook."

The yield on the 10-year U.S. Treasury note was little changed following the release, stalled at roughly 2.75%, but stocks bounced to session highs after the minutes were released. Recently, investor fears have shifted away from higher rates and toward the possibility of a recession as inflation remains near 40-year highs.

"There weren't any surprises which is why we probably bounced, and even after it hit, we've been all over the place," said Peter Boockvar, chief investment officer at Bleakley Advisory Group. "There's nothing new in it, but the markets didn't want to hear anything more hawkish than the hawkishness they already laid out."

Money Report

Retail also remained in focus Wednesday, leading the market higher after the major averages opened in the red. The reversal followed a report that bidders are still competing to acquire Kohl's, whose shares jumped nearly 11.9%. The SPDR S&P Retail ETF gained 6.8%.

Nordstrom shares leapt more than 14% after the company surpassed sales expectations and raised its full-year outlook. Dick's Sporting Goods gained about 9.7% on strong earnings despite cutting its outlook. Best Buy climbed nearly 9%, despite getting a downgrade from Barclays, which followed a mixed earnings report Tuesday.

Retailers have been on an earnings-reporting spree since last week that has held the attention of investors anxious to see how companies are managing sky-high inflation. Investors and analysts have pointed out that what had appeared to be a retail wreck reflects a shift in consumers' demand for services rather than goods. Some have suggested stocks may be getting overly punished for their results.

"I know everybody's focused on Walmart and Target," which spooked investors when they plummeted on weak results last week, "but let's focus on something like TJX that actually delivered and raised their margin guidance," Hightower Advisors chief investment strategist Stephanie Link said Wednesday on CNBC's "Squawk Box."

"Services and high-end are actually still doing pretty good," she added, noting Ralph Lauren's top- and bottom-line beats, as well as positive performance in Nordstrom's designer and shoe business that "helped comps because people wanted to buy things for occasions."

Elsewhere, tech stocks bounced after leading market losses in the previous session. Intuit jumped 8.2% after the tax software company reported better-than-expected quarterly profit and revenue, and the firm raised its current quarter outlook. DocuSign and Zoom Video each rose more than 8%, too. Nvidia added 5% ahead of its earnings after the bell.

Consumer discretionary and energy were the best performing sectors in the S&P 500. They rose about 2.8% and nearly 2%, respectively.

Even with the day's gains all of the major averages are still well off their lows. The Nasdaq Composite, which outperformed the other indexes Wednesday, is still deep in bear market territory, down about 29.5% from its 52-week high. The S&P 500, which has fought to avoid crossing into a bear market, is now 17.4% from its record. The Dow is 13% from its high.