At a time when many Americans are relying on credit cards to make ends meet, a new survey reveals 1 in 4 cardholders say they’ve involuntarily had their credit limit slashed on at least one of their credit cards, or even had a card closed by their issuer in the past 30 days.

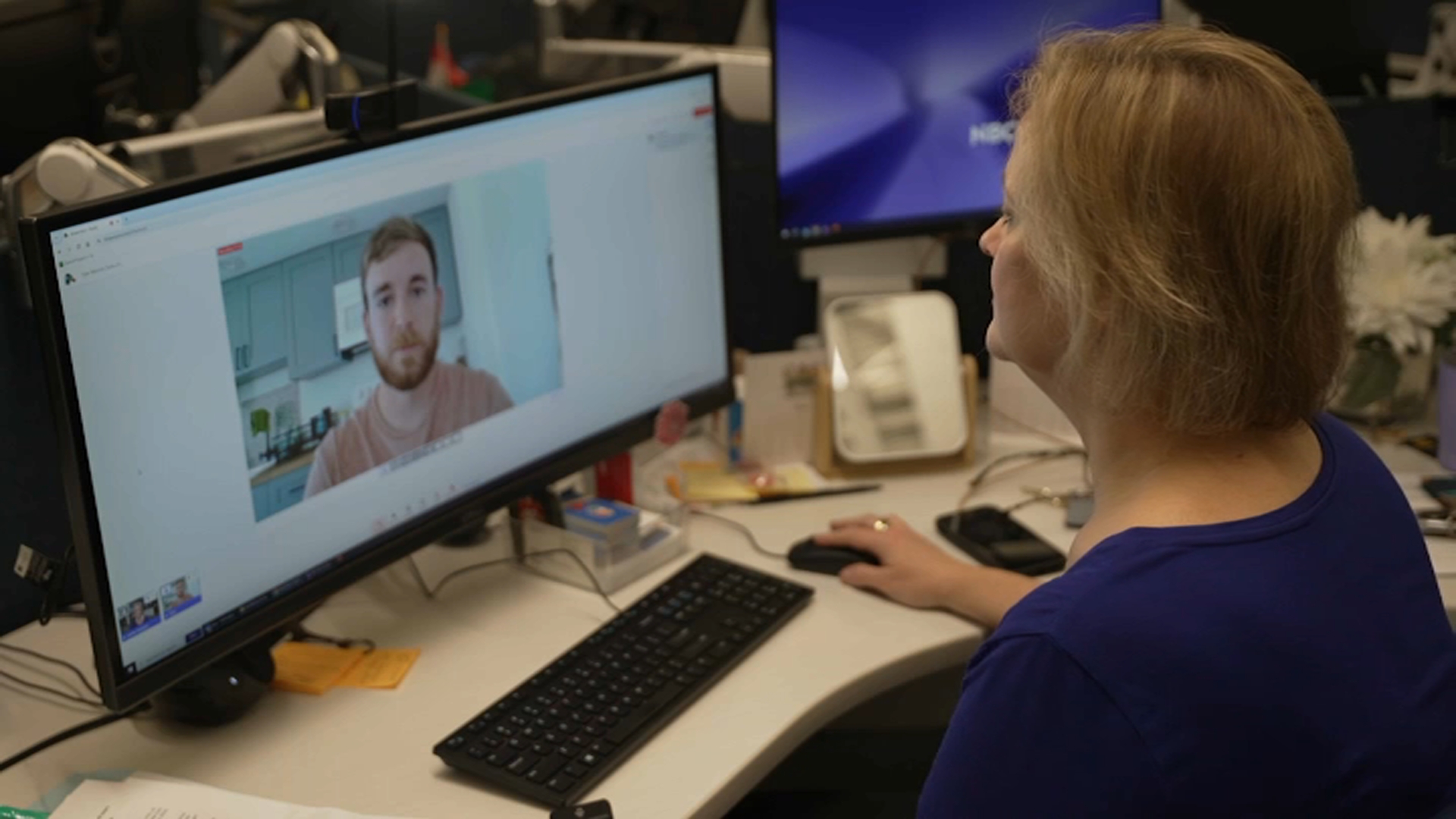

Ted Rossman, an industry analyst with CreditCards.com, says dormant cards are prime candidates for cancellation. They represent a lot of risk and little benefit for credit companies.

"If you want to keep those cards activated, and it's a good thing for your credit score to do so, just use them," Rossman said. "A lot of times if they haven't been used in 6-12 months, they are at risk of cancellation, but if you use it, even it's a small charge that you pay off right away, that should be enough to keep you going."

If you're currently in financial distress your card is also at risk of being cut off, or your limit may be reduced.

"You are bumping up against the credit limit, you're paying late, you're credit score has fallen considerably, these are all risky scenarios that the credit card companies can use as justification for cutting your limit or canceling your card," Rossman said.

So what can you do? Rossman says be proactive and contact your card company. If you need help, they may waive your payments, or other fees, or lower your interest rate, but you have to ask.

NBC10 Boston Responds

If you’ve been cheated or swindled, NBC10 Boston Responds is fighting to recoup your money.

"If they have to chase you down, they're probably not going to be as forgiving, so speak up promptly," Rossman said. "Do it early. These credit card companies are being generous, like Apple Card, for example, let card owners skip the April payments upon request, and they didn't even charge interest. American Express and Capital One reportedly did something similar to a number of their card owners."

Rossman warns against using a credit card as an emergency fund. He says it's a good idea to keep cash on hand, and to use your stimulus payment for necessities, not to pay credit card balances. If you can't get through to your credit card company on the phone, you can also reach out to them via email or through social media.