- Natural gas becomes more expensive as investors worry about whether enough of the commodity has been stored for the winter.

- Europe's shortages are most acute and the amount of gas in storage at this time of year is now at a record low.

- The weather in late fall and early winter could determine how high prices could go.

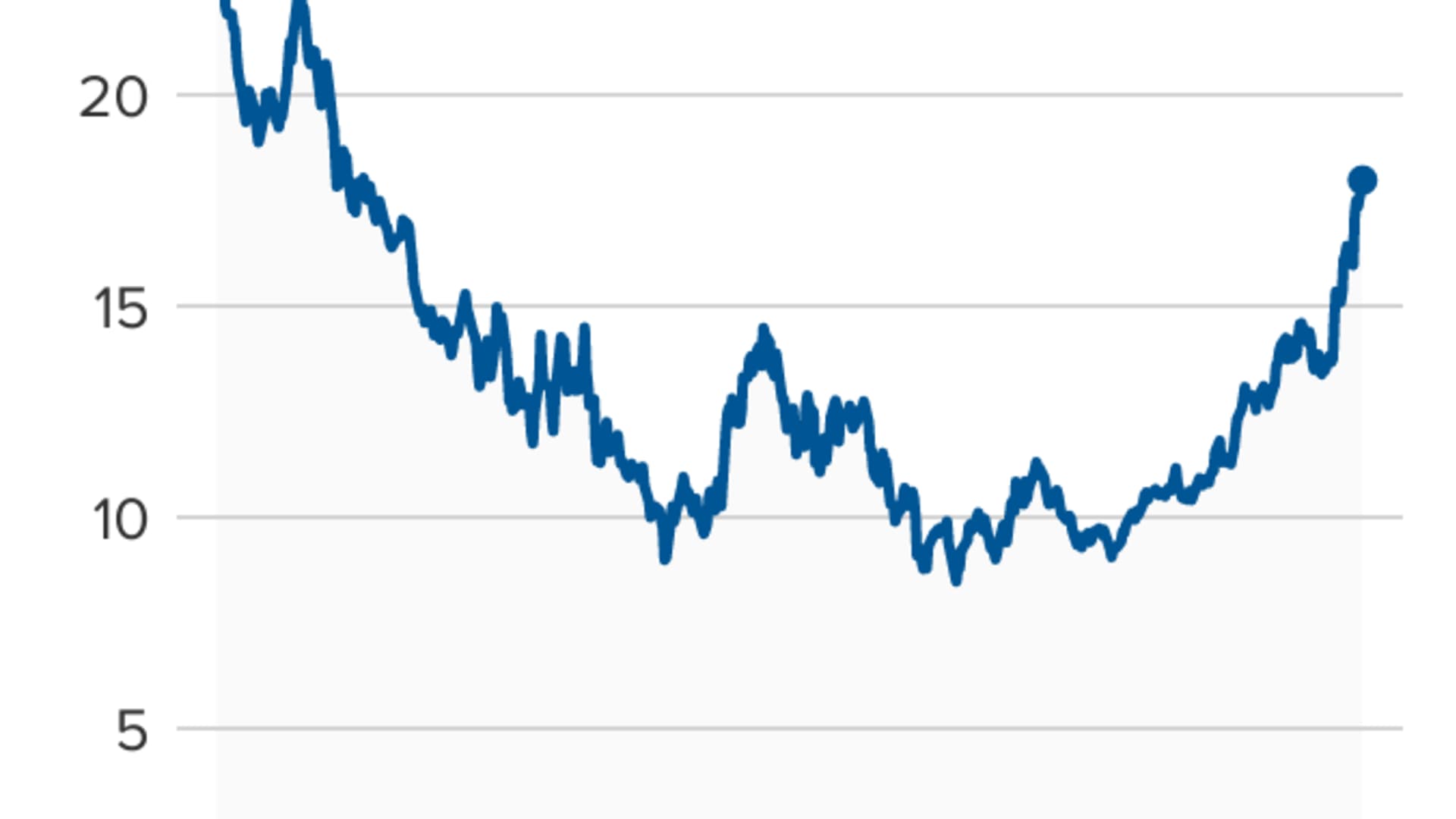

Natural gas prices have surged more than 35% in the past month, as worries grow there is not enough gas stored up for the winter should temperatures be especially cold in the northern hemisphere.

The usually quiet market for the commodity has become hot in the last couple of weeks, as investors focus on the growth in demand around the world and supplies remain below normal. The biggest problem area is Europe, where supply is at a record low for this time of year.

Even in the U.S., the amount of gas in storage is 7.6% below the five-year average, according to recent data from the U.S. Energy Information Administration. Natural gas is an important heating fuel and is responsible for about 35% of power generation in the U.S., the federal agency found.

Get Boston local news, weather forecasts, lifestyle and entertainment stories to your inbox. Sign up for NBC Boston’s newsletters.

"People are starting to throw the 'crisis' word around" when it comes to Europe, said John Kilduff, partner with Again Capital. He said natural gas in storage in Europe is 16% below the five-year average, and the level in storage is a record low for September.

"Europe is squarely behind the eight ball going into the winter season. It's going to put the focus on this commodity that's been overlooked for the last several years," said Kilduff.

The tipping point could come in several months when it becomes clear what type of winter is ahead for Europe, and also the U.S. Some analysts say in an extreme scenario, U.S. prices could double if there is an extended cold spell, particularly in Europe where shortages could get severe.

Money Report

"If the winter is mildly cold, it's going to be problematic for sure," said Francisco Blanch, head of commodities and derivatives strategy at Bank of America.

Rising prices for natural gas

Natural gas futures for October jumped nearly 5.3% Monday, to about $5.20 per one million British thermal units, or mmBtus. Natural gas is up 106% year-to-date and is the highest in more than seven years. But the equivalent gas in Europe and Asian markets is upwards of $20 per mmBtus.

"The U.S. is supposed to be an island, but in the last three or four years, there's an increasing link between the U.S. and global market," Blanch said. "We've gone from 50% correlation to 95% correlation. The U.S. market is being dragged around by this."

The U.S. has been exporting natural gas, in the form of liquified natural gas shipments. The shipments have grown to about 10% of U.S. production, analysts said. South Korea is the largest customer, followed by China and Japan, according to U.S. government data. But buyers also include Brazil India, Poland, Spain, France and Portugal.

"If it's a cold winter, gas will not just be tight. It will be very tight," said Daniel Yergin, vice chairman of IHS Markit. If that's the case, prices could go sharply higher. "It will either be physical shortages, or it will be reflected in price."

Strategists say for now the world's gas supply is stretched, but prices could fall if the autumn and early winter are mild, and more gas is put in storage.

"We lean toward a lot of risks for price spikes, rather than higher and higher sustained prices," said Christopher Louney, commodities strategist at RBC.

Weather patterns and gas demand

Brian Lovern, chief meteorologist at Bespoke Weather, said the U.S. is in a La Niña state, which could mean a warmer than normal October and November in the northern U.S.

Fewer days that require heating could mean more gas will go into inventories before the coldest winter weather.

"I think in a few weeks, the weather is going to give us some bearish headwinds [for natural gas] as we get into the October, November period. That does not mean we won't see a colder winter," he said.

Europe's winter will depend on a weather pattern that sets up over Greenland. "The early indications do not indicate a big cold winter over there," Lovern said.

The market is anxious about a repeat of last year, when a cold winter in Europe resulted in a larger-than-normal drawdown of gas.

Supplies were not built back up enough in Europe, and analysts said lately Russia had cut back on some exports into Europe. But the new Nord Stream 2 pipeline, bringing natural gas from Russia to Europe, could resolve some of the supply problems for the continent in the next couple of months.

Russia's Gazprom last week announced completion of the pipeline, which had once been opposed by the U.S. The pipeline would allow Russia to double gas exports to Europe. Germany's energy regulator Monday said it has four months to complete certification of Nord Stream 2.

Global impact

The situation in Europe has caught the attention of U.S. officials. Amos Hochstein, the U.S. State Department's senior advisor for energy security, told reporters Friday that he was concerned about supply, and potential shortages if the winter is very cold.

Hochstein said U.S. deliveries of liquified natural gas, known in the industry as LNG, can be increased and Russia is coming off the period of low supply.

"There's different explanations for what's going on, why Russian supplies are constrained," said Yergin. "Russian and German regulators are in a debate as to whether new regulations apply that were put in place after the pipeline was given its final investment decisions."

Yergin said Asian demand has also been a factor in the short supplies. Chinese liquified natural gas demand was 20% higher than what was anticipated, he said.

TortoiseEcofin's senior portfolio manager Rob Thummel said Europe also did not get sufficient liquified natural gas cargoes to rebuild its inventories. "What happened was Brazil hydroelectric power didn't come to fruition," he said.

"There was drought, so Latin America and Brazil needed natural gas," Thummel added. During Europe's summer, "a lot of LNG... ended up in Brazil in particular."

Supplies in Europe were not replenished, and there was a jump in demand. "Asia and China in particular got nervous. They started buying LNG," he said.

Thummel said he does not expect a serious problem for the U.S. this winter, and prices could come back down. He said there has been an increase in rig count in the Haynesville shale. "You're likely to see higher volumes," he said.

One issue for the U.S. has been lower volumes of shale oil production. A byproduct of that production is natural gas.

"I would say the volatility in U.S. price will not be the same as it has been, and likely will be in Europe," said Thummel. The amount of gas going into winter is about 8% below the five-year storage average, but "it's not the end of the world," Thummel said.

As natural gas prices have jumped, so have the stocks of gas producers, like the largest EQT, Range Resources, and Antero Resources. Investors have also jumped into the United States Natural Fund ETF, which bets on the commodity.