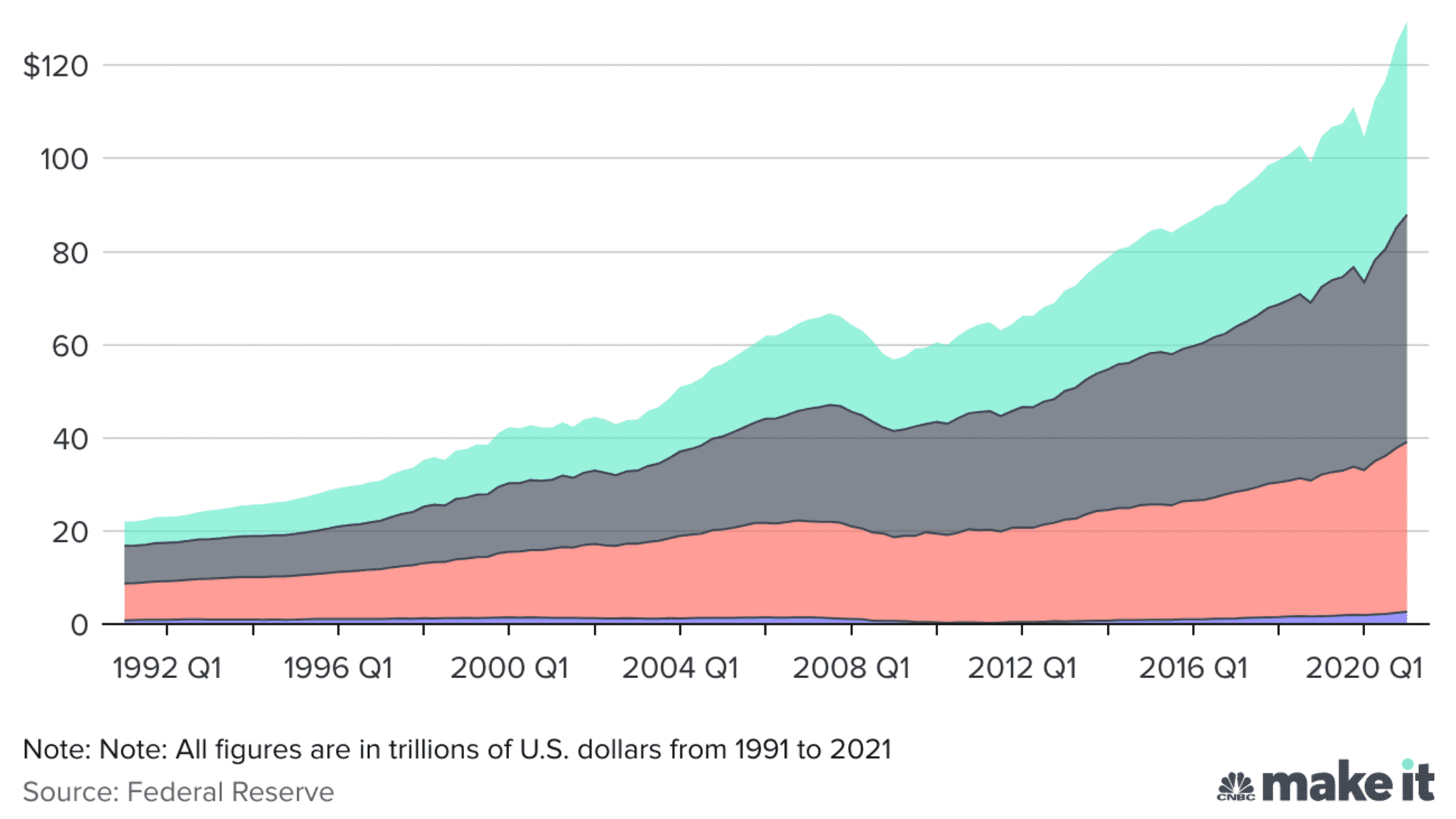

The wealthiest 1% of Americans controlled about $41.52 trillion in the first quarter, according to Federal Reserve data released Monday. Yet the bottom 50% of Americans only controlled about $2.62 trillion collectively, which is roughly 16 times less than those in the top 1%.

Wealth across all U.S. households increased during the first quarter. Overall, the net worth of households and nonprofits rose to $136.9 trillion during the first quarter, a 3.8% increase from the end of 2020, according to separate data published by the Federal Reserve on June 10, 2021. But those gains weren't distributed equally.

WATCH ANYTIME FOR FREE

Stream NBC10 Boston news for free, 24/7, wherever you are. |

Net worth is essentially a calculation of all of a person's assets — including cash in checking and savings accounts, financial investments and the value of any real estate or vehicles owned — minus all their debt, including credit card balances, student loans and mortgages.

The recent gains in household wealth, in particular, can be largely attributed to stock holdings, which were up about $3.2 trillion, according to the Fed. The rise in home values also played a role, with real estate holdings increasing by $1 trillion.

Get updates on what's happening in Boston to your inbox. Sign up for our News Headlines newsletter.

But some critics contend that the Fed's low interest rate policies have boosted the stock market, giving an edge to those who own stocks and investments. The wealthiest 10% of Americans, for example, own about 89% of stocks and mutual funds held in the U.S. as of the first quarter of 2021, according to Fed data. The bottom 50% of U.S. households hold around 0.5%.

It is true that the divide between the wealthiest Americans and the bottom half of U.S. households has widened over the last few decades. In the first quarter of 1990, the top 1% had roughly six times the wealth as the bottom half of Americans.

Money Report

More from Invest in You:

As 'buy now, pay later' apps become more popular, proceed with caution

How inflation will dip into your pocket and what you can do about it

Lack of workers is hurting businesses' ability to keep up with demand

In a written testimony, Federal Reserve Chairman Jerome Powell said Tuesday that the U.S. economy has seen "sustained improvement" since the start of the Covid-19 pandemic but noted that the bounce back has not been equal.

"The economic downturn has not fallen equally on all Americans, and those least able to shoulder the burden have been the hardest hit," Powell said. He noted that unemployment persists among lower-wage workers in the service sector and among Black and Hispanic Americans.

Yet Powell sees reason for optimism coming out of the pandemic, particularly for those who have been left behind in the past. "Those who have historically been left behind stand the best chance of prospering in a strong economy with plentiful job opportunities," he said.

"Our economy will be stronger and perform better when everyone can contribute to, and share in, the benefits of prosperity."

SIGN UP: Money 101 is an 8-week learning course to financial freedom, delivered weekly to your inbox.

CHECK OUT: Single mom earns $10,000/month on Outschool: 'I would have never been able to make as much money as a regular teacher' via Grow with Acorns+CNBC.

Disclosure: NBCUniversal and Comcast Ventures are investors in Acorns.