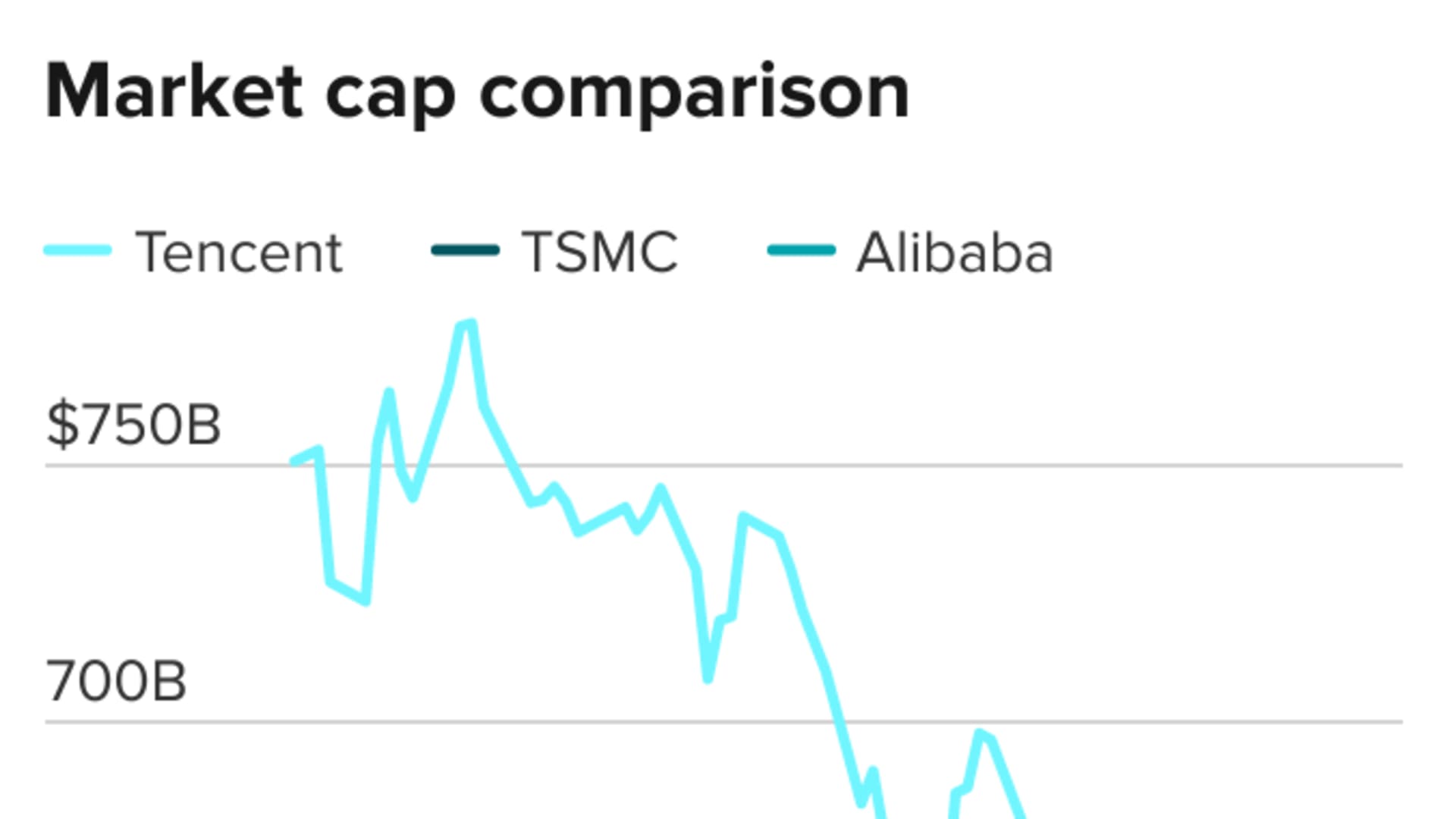

- The world's largest chipmaker Taiwan Semiconductor Manufacturing Company (TSMC) has overtaken Chinese tech behemoth Tencent to become Asia's most valuable firm.

- The market capitalization of China's Tencent and Alibaba have plummeted amid an ongoing regulatory crackdown on the tech sector by Beijing.

- Chipmaker TSMC, on the other hand, has gotten a boost as the world faces a global semiconductor shortage driven by supply chain disruptions due to the pandemic, along with a surge in demand from industries such as automobiles and data centers.

The world's largest chipmaker Taiwan Semiconductor Manufacturing Company (TSMC) has overtaken Chinese tech behemoth Tencent to become Asia's most valuable firm.

It comes as Beijing's regulatory crackdown on the country's tech sector in the past few months has slammed the valuations of Chinese tech giants Tencent and Alibaba.

Get Boston local news, weather forecasts, lifestyle and entertainment stories to your inbox. Sign up for NBC Boston’s newsletters.

TSMC, a major supplier to Apple, overtook Tencent earlier in August. The Taiwanese chipmaker is now sitting at the top spot by market capitalization — among Asia firms — at more than $538 billion, according to data from Refinitiv Eikon as of Wednesday morning during Asia hours.

Tencent sat in second place, with a market capitalization of more than $536 billion while Alibaba was a distant third at about $472 billion.

China's crackdown hurting tech companies

Money Report

The market capitalizations of both Tencent and Alibaba were hit again on Tuesday — losing more than $20 billion each — after China's market regulator issued draft rules aimed at stopping unfair competition on the internet.

In this latest move on the tech sector, China's State Administration for Market Regulation highlighted the regulator's push to tighten laws surrounding antitrust and competition. Other areas that have come under regulatory scrutiny from Beijing include financial technology as well as the collection and use of data.

Chinese technology stocks have tumbled as uncertainty continues to cloud the sector. The Hang Seng Tech index, which tracks the largest technology companies listed in Hong Kong including Tencent and Alibaba, has dropped more than 25% since the start of the year.

TSMC benefits from semiconductor shortage

Chipmaker TSMC, on the other hand, has gotten a boost as the world faces a global semiconductor shortage driven by supply chain disruptions due to the pandemic, along with a surge in demand from industries such as automobiles and data centers.

Responding to the shortage, TSMC said earlier this year it plans to invest $100 billion over the next three years to increase capacity, according to Reuters.

Since the start of the year, TSMC's stock has risen by more than 6%. Taiwan plays an outsized role in the chipmaking realm, dominating the foundry market, or the outsourcing of semiconductor manufacturing. Much of this dominance is attributable to TSMC, whose clients include Apple, Qualcomm and Nvidia.

— CNBC's Arjun Kharpal and Yen Nee Lee contributed to this report.