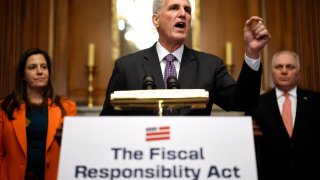

Speaker of the House Kevin McCarthy (R-CA) holds a news conference after the House passed The Fiscal Responsibility Act of 2023 in the Rayburn Room at the U.S. Capitol on May 31, 2023 in Washington, DC.

This report is from today's CNBC Daily Open, our new, international markets newsletter. CNBC Daily Open brings investors up to speed on everything they need to know, no matter where they are. Like what you see? You can subscribe here.

What you need to know today

WATCH ANYTIME FOR FREE

Stream NBC10 Boston news for free, 24/7, wherever you are. |

- The bill to suspend the U.S. debt limit passed a House vote 314-117, with support from both Democrats and Republicans. The Fiscal Responsibility Act will now go to the Democrat-controlled Senate, where leaders want to pass it within 48 hours.

- U.S. stocks slipped slightly Wednesday, with all three major indexes falling less than 1%. Asia-Pacific markets mostly traded higher Thursday. Factory activity in China and Japan rose in May, according to separate private surveys. China's Shanghai Composite added 0.43%, while Japan's Nikkei 225 rose 0.74% in response.

Get updates on what's happening in Boston to your inbox. Sign up for our News Headlines newsletter.

- Financial markets are at risk of a sharp downturn amid today's fragile economic outlook, European Central Bank Vice-President Luis de Guindos told CNBC. Tighter financial conditions after March's banking turmoil, along with persistent inflation, pose a threat to stocks, he said.

- Around 2,000 Amazon employees walked off the job Wednesday, in protest of the company's return-to-office mandate, mass layoffs and environmental record. Separately, Amazon will pay the Federal Trade Commission more than $30 million to settle allegations of privacy lapses in its Alexa and Ring divisions.

- The Job Openings and Labor Turnover Survey from the Labor Department showed job openings increasing to more than 10 million in April, a higher number than March's and more than economists expected. Still, note that JOLTS' data lags: the numbers are for April, not May.

- PRO Ever since Nvidia's meteoric ascent last week, investors have been focusing on other semiconductor firms that would similarly benefit from the artificial intelligence boom. But investors shouldn't ignore software companies that harness AI, advised Bank of America.

The bottom line

Money Report

The old Wall Street adage to sell in May and go away held true this year — aside from AI-related stocks, that is.

On the last trading day of May, the S&P 500 lost 0.61%, the Dow Jones Industrial Average fell 0.41% and the Nasdaq Composite slid 0.63%. For the month, the S&P inched up 0.3%, the Dow sank 3.5% and the Nasdaq jumped 5.8%.

What jumps out here is the discrepancy between the Dow and the S&P. The tech-heavy Nasdaq was, quite clearly, enjoying the surge in AI-related stocks. The Dow was weighed down by losses of more than 10% in stocks like Nike, Walt Disney and Chevron. But the simple exclusion of Nvidia from the Dow was a big factor in the index's poor showing compared with the S&P, a sign of how much heavy lifting Nvidia has been doing in May.

Cryptocurrency might want to divorce itself from traditional financial systems, but it can't escape the gravitational pull of Wall Street. Bitcoin lost 2.77% and ether fell 2.2% yesterday; for the month, bitcoin's down 7.9% and ether slid 2.05%, giving them their first losing month in 2023.

If history proves a reliable guide, June won't be any better than May, unfortunately. According to The Stock Trader's Almanac analysis of data from 1950 to 2022, in an average June, the S&P tends to rise 0.1% while the Dow typically loses 0.2%. Early signs seem to corroborate the trend. Stock futures mostly ticked down Wednesday night even after the House passed the bill to suspend the debt limit.

Those aren't confidence-inspiring numbers, but a quick caveat: In markets, history tends not to rhyme.

Subscribe here to get this report sent directly to your inbox each morning before markets open.