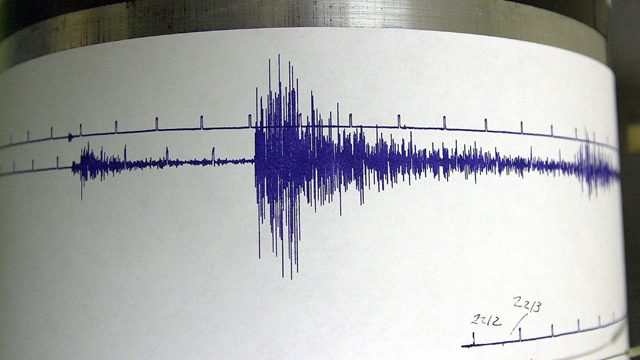

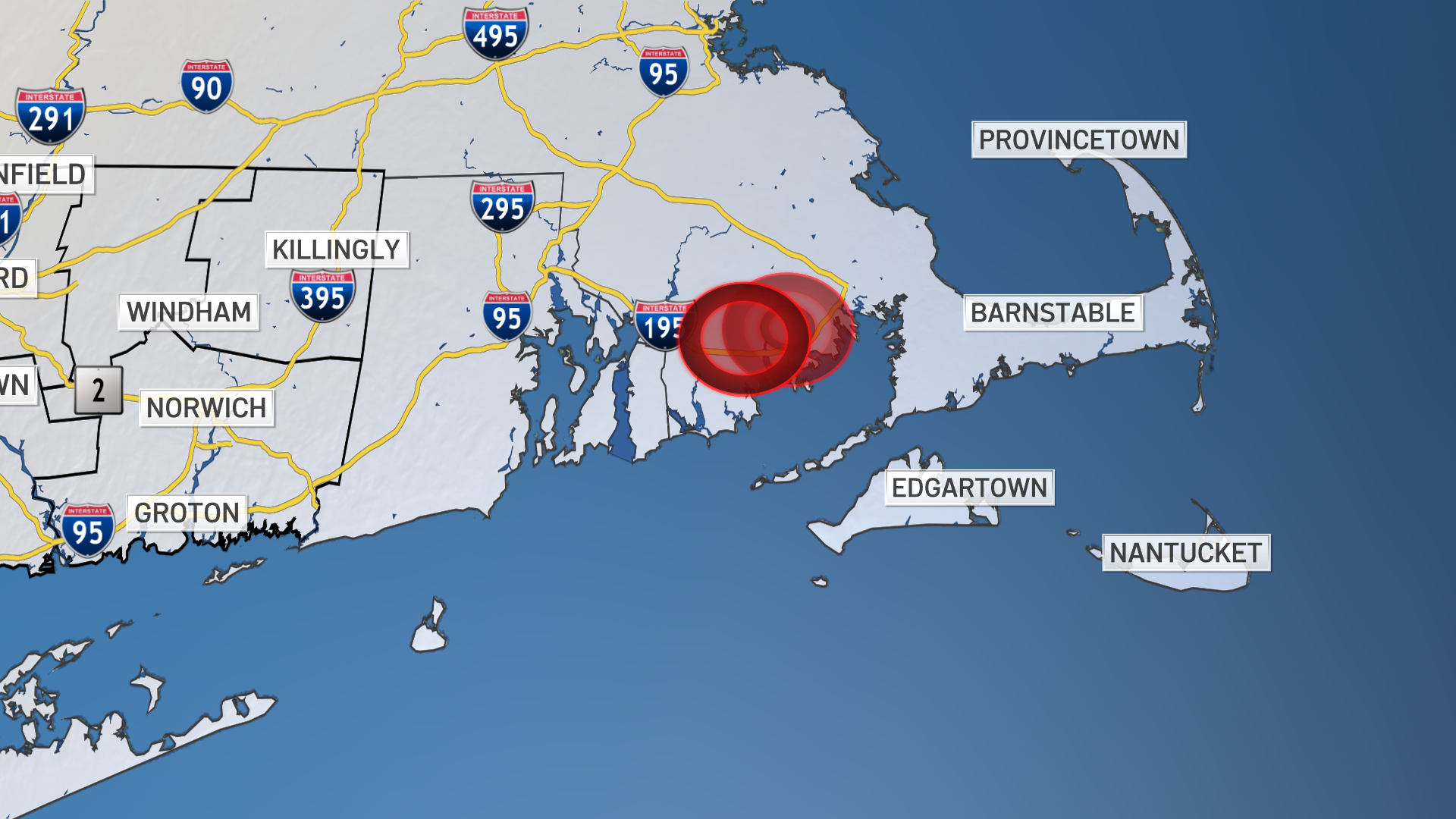

The strongest earthquake to hit southern New England in decades rattled homes on Sunday morning.

The earthquake didn’t cause any significant damage, but it may have you wondering about whether you are covered for damages if there’s a bigger one down the road.

“Most people feel like that is something that happens out in California and not in our back yard, but Sunday was a reminder that it can in fact happen," said George Doherty, President of Corcoran & Havlan Insurance Group in Wellesley.

More on Sunday's Earthquake

He says some of his clients have purchased earthquake coverage this week after Sunday’s rumbling.

“Earthquake insurance is not covered by a homeowners policy but it can be added by endorsement,” Doherty said. “It would cover any damage to your property as a result of the earthquake. That could be collapse, that could be cracks in your walls, that could be anything that would warrant your house to be repaired or rebuilt as a result of the earthquake. Any personal property or contents within the home that were damaged would also be covered.”

Doherty says it’s relatively inexpensive -- adding the coverage to your homeowner’s policy will cost anywhere between $100 to $300 annually, depending on the value of your home.

For peace of mind, you may want to consider it, but if you’d rather play the odds, experts say there have only been about nine earthquakes the size of the most recent one in New England since the 1700s.

“What we see is generally it’s on their mind for about a week and we do have a few folks that will want that coverage,” Doherty said. “But eventually, people will resume to their normal everyday activities and only check in again when there is a tremor."

Another thing you need to know about earthquake insurance -- it carries a higher deductible than a typical homeowners insurance deductible.