- As the president of the National Bureau of Economic Research and a member on the Business Cycle Dating Committee, James Poterba helps determine when a recession officially starts and ends.

- CNBC interviewed the MIT economist about the practice of dating downturns, and discussed why the work matters.

As the president of the National Bureau of Economic Research and a member on the Business Cycle Dating Committee, James Poterba helps determine when a recession officially starts and ends. Why is that important? What do those dates tell us?

When the NBER was founded in 1920, its economists mainly studied workers' income, businesses and capital, said Poterba, who is also an economics professor at the Massachusetts Institute of Technology. However, noticing that things didn't stay good or bad for too long — they were always changing — the bureau soon turned its attention to the cycles of the economy, as well.

Although there was less economic data available a century ago, "it was understood by anyone observing the economy that there were times when economic activity happened faster and more slowly, and when there was more or less going on," Poterba said.

Get Boston local news, weather forecasts, lifestyle and entertainment stories to your inbox. Sign up for NBC Boston’s newsletters.

More from Personal Finance:

73% of millennials are living paycheck to paycheck

Americans are saving far less than normal

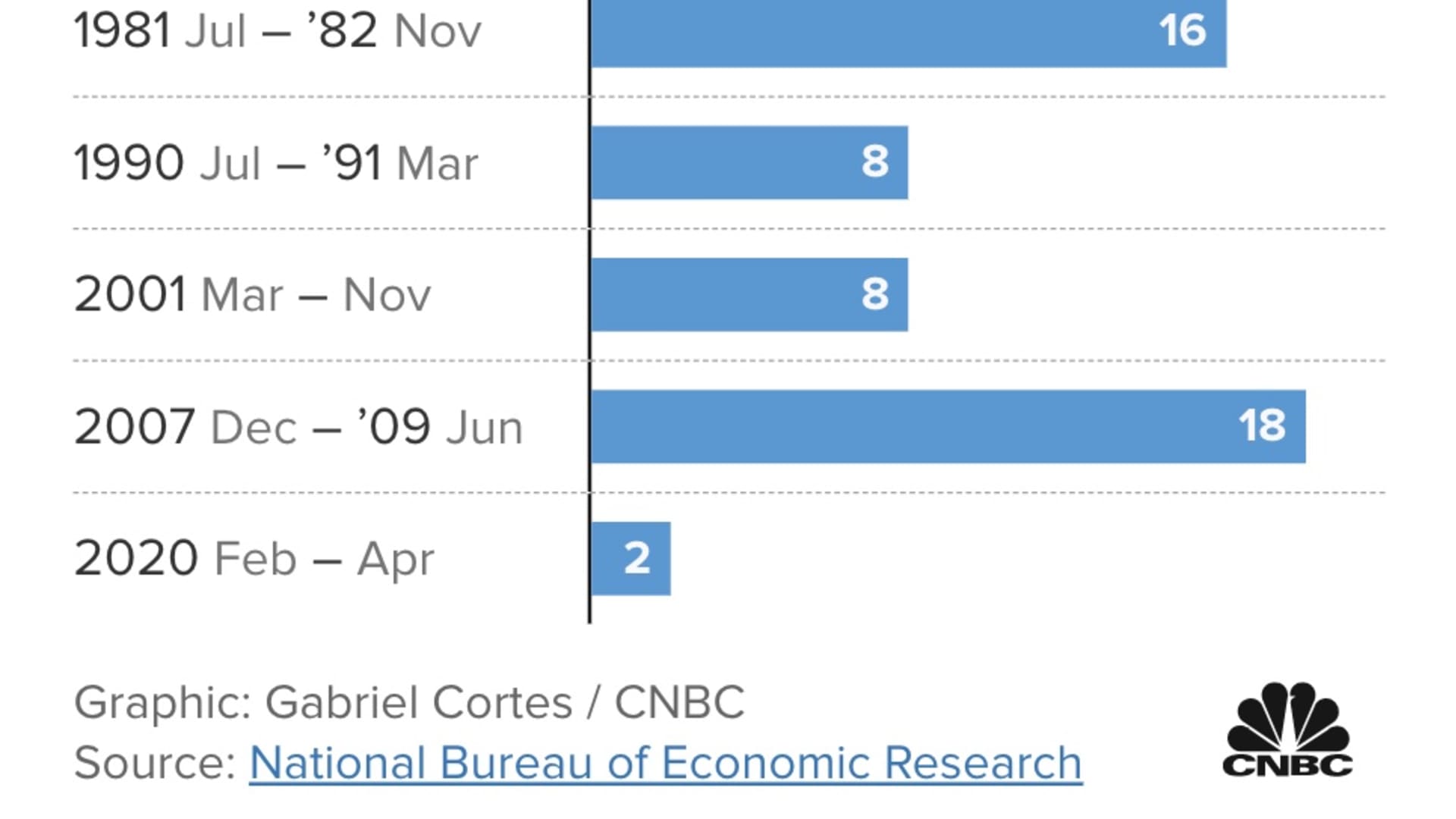

A recession may be coming — here's how long it could last

The economists at the NBER wanted to know if these fluctuations were inevitable. And so they set out to understand why they occurred.

To ascertain the factors that precipitated a downturn, they'd have to find a precise way to pin when exactly the economy began to contract. Today, NBER's Business Cycle Dating Committee, a private organization of academics based in Cambridge, Massachusetts, is considered an authority on the timeline of recessions.

Money Report

With Federal Reserve economists predicting that the economy will enter a slump later this year, I spoke with Poterba about his research on recessions. While NBER doesn't make any forecasts, he still had lots of interesting things to say about our downturn worries. (Our interview has been edited and condensed for clarity.)

Annie Nova: What is the main purpose of dating a recession's start and finish?

James Poterba: So that, as we look back as students of economic fluctuation, we can try to understand what caused particular increases and decreases in the level of economic activity.

AN: How does this information help us as a society?

JP: It ultimately helps to design policy going forward. It enables us to look back and say, for example, what are the consequences of interest rate increases? What is the chance that an increase of interest rates is associated, sometime afterwards, with a period of declining economic activity? Or, if you see a large run-up in oil prices, does that typically lead to a recession?

AN: Some economists talk about recessions as inevitable in our current financial system. Why is that?

JP: That's a very complicated question. If you go back in U.S. history to the agrarian economy days, I always think that's an easy way to sort of understand some of this, though. If you had a very harsh winter, or if you had a drought, those are periods when the economy would experience a decline. And so today, when you have a shock like an increase in commodity prices, or a transportation disruption that impedes the ability to trade, those are all variables which can affect what happens in the economy.

AN: Do you have a sense of what language people used to describe downturns before the term "recession" took off?

JP: If you go back to the earliest work of the NBER, and now I'm literally talking 100 years ago, they used language like "business panics" or "crashes."

AN: What factors does the committee use to determine that the U.S. is in a recession?

JP: A recession is a period of broadly dispersed decline in economic activity that lasts for a protracted period and is of substantial depth. So, it's depth, diffusion and duration — the three Ds.

AN: Your committee's recession timelines do not tell the full story of a downturn, right? Some people continue to face financial consequences for a long time after the economy begins to recover.

JP: One of the places where there's been some demonstration of the long-lived impacts of recessions is with college graduates. Graduating with your undergraduate degree in the midst of a recession is less good from the standpoint of earnings than graduating in a very tight labor market. Even if you look a decade later, their earnings are still somewhat lower. Also, when workers are out of the labor market, when they're not able to find jobs, that can lead to some decay of their skill set. And that has longer-lived effects too.

AN: Maybe because there is so much data available today, or maybe it's the nature of the news cycle, but it feels like we're always talking about a recession now. Even when we're not in one, we can't stop talking about the next one. Do you feel that?

JP: You're right that there is a lot of media interest in the question of, is the economy likely to go into a downturn? Or, when the economy is doing poorly, is it likely to recover? Frankly, I think that's kind of a shorthand for the conversation about, are things going to get better or worse? The words "recession" or "recovery" have become shorthand in those conversations.