Days before unveiling her fiscal 2025 budget plan and with state tax collections weakening, Massachusetts Gov. Maura Healey unveiled her plans to boost state aid to cities and towns and give municipalities the ability to raise certain taxes.

The budget will feature $8.7 billion in local aid, a 3% increase compared to this fiscal year, Healey announced to local officials during remarks at the Hynes Convention Center.

The $8.7 billion figure includes raising unrestricted general government aid to $1.31 billion, a 3% bump, and Chapter 70 local public school aid to $6.86 billion, a $263 million or 4% increase.

Healey also unveiled two legislative packages at the Massachusetts Municipal Association's annual meeting.

Get Boston local news, weather forecasts, lifestyle and entertainment stories to your inbox. Sign up for NBC Boston’s newsletters.

The Municipal Empowerment Act would enable cities and towns to generate more revenue by raising the maximum local option tax on hotels, motels and other rentals from 6% to 7% of the price of a room, Healey's office said. In Boston, the tax could rise from 6.5% to 7.5%.

The local options meal tax could increase from 0.75% to 1%, under the governor's plan.

Healey also rolled out a new local option vehicle surcharge plan under which a 5% surcharge fee could be assessed by local officials on vehicles registered in their communities based on the vehicle's value.

Get updates on what's happening in Boston to your inbox. Sign up for our News Headlines newsletter.

Healey plans to file that bill Monday, as well as a two-year $400 million Chapter 90 bill that would be supplemented with a $100 million boost for local road and bridge repairs funded with income surtax revenue and another $24 million to support rural communities.

"The Municipal Empowerment Act proposes multiple reforms that municipal leaders have asked for to improve the services they can provide to their communities and make operations more efficient. We are also proud to be increasing funding for roads, bridges, schools, and municipal services to improve quality of life in all of our communities," Healey said in a statement.

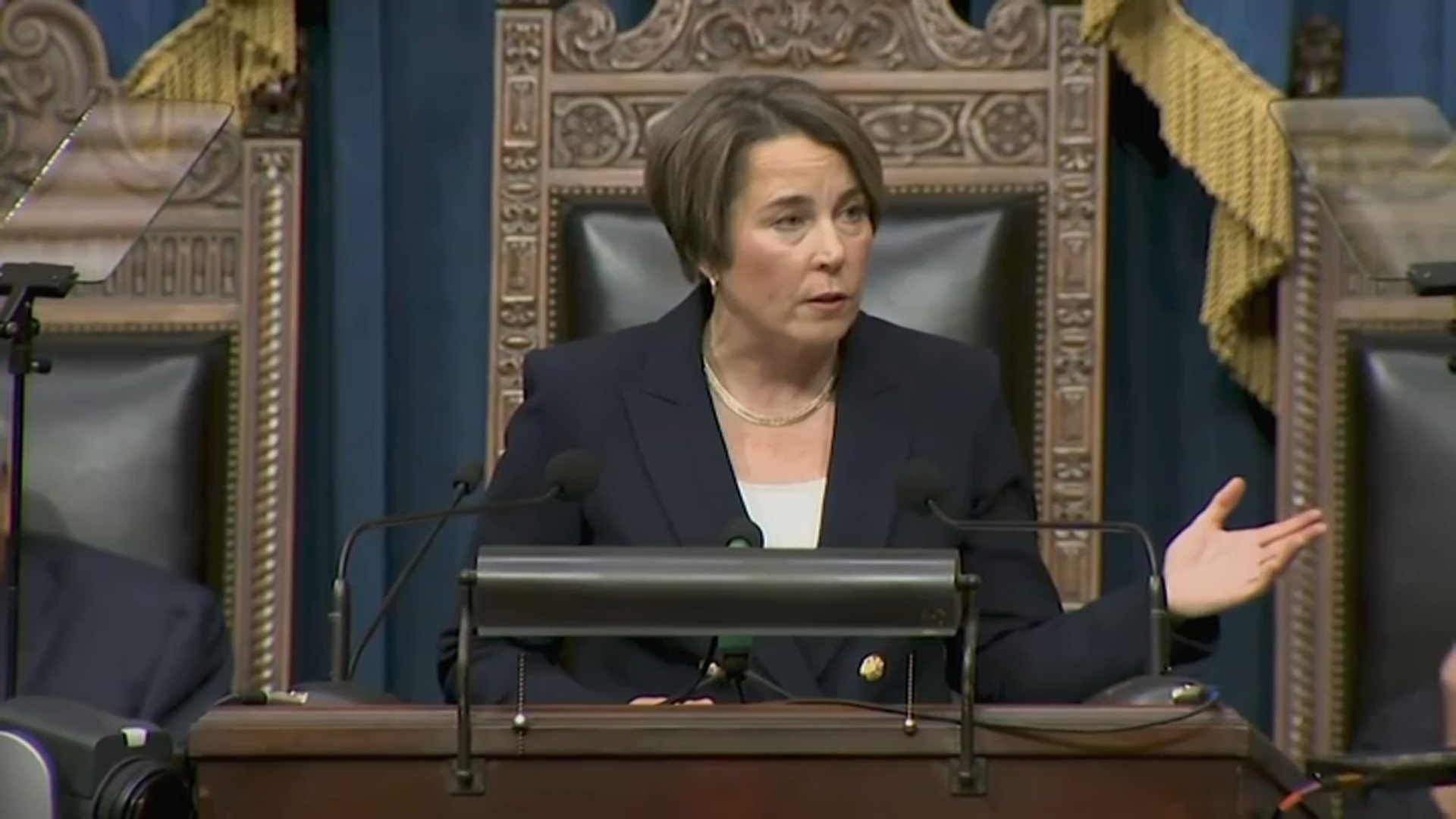

Friday's announcements from the governor build on a menu of spending increases she outlined Wednesday night during her State of the Commonwealth address.

On Thursday, reporters asked the governor, who just had to cut spending and reach for new non-tax revenue to snap this year's budget into balance, if she planned to pursue any tax or fee increases to help cover the new costs.

"No," Healey said. "We've got to remind the public we're still seeing revenue growth. We see revenue growth this year over last year, it just happens it's growing at a slower rate. I promised last night [to] the people that I'm only going to file a budget that is fiscally responsible. That's what you're going to see next week.""