- Few college admission cycles have been as tumultuous as this one.

- As schools are forced to rethink their policies in the wake of the Supreme Court's ruling against affirmative action, it's not an easy time to be a college applicant, especially for students of color.

- And then there is the issue of financial aid.

With competition at an all-time high and admissions practices increasingly unclear, it's not an easy time to be a college applicant, especially for students of color.

The Supreme Court's ruling against affirmative action was considered a massive blow to decades-old efforts to boost enrollment of minorities at American universities through policies that accounted for applicants' race.

Get Boston local news, weather forecasts, lifestyle and entertainment stories to your inbox. Sign up for NBC Boston’s newsletters.

"In terms of ensuring access to higher education and income opportunities, the barriers are already so high," said Cara McClellan, director of the Advocacy for Racial and Civil Justice Clinic and practice associate professor of law at the University of Pennsylvania Carey Law School.

However, this year's admissions cycle, which marked the first in which race was not considered, is already reflecting an unexpected dynamic.

College application volume is rising

Money Report

As of Jan. 1, college application volume rose 9% in the 2023-24 academic year compared with a year earlier, according to the latest report by the Common Application.

More students are applying overall, and a larger share of applicants identified as an underrepresented minority. The percentage of first-year applicants identifying as Black or Latino jumped 12% and 13%, respectively, year over year, outpacing other groups.

At the same time, colleges are seeing an increase in first-generation applicants and international students, the Common App found.

More from Personal Finance:

Here's what to do if your financial aid letter is late

Biden administration forgives $4.9 billion in student debt

College enrollment picks up, but student debt is a sticking point

Experts predicted the Supreme Court's ruling would encourage colleges to put more weight on students' household income and their regional background to diversify their student bodies.

Already, the number of applicants from below-median-income ZIP codes is notably higher, rising 12%, while more students requested a fee waiver, which is often used as a proxy for low-income status, according to the Common App.

These changes may be explained, in part, by an effort on behalf of colleges to enhance their recruitment efforts and financial aid awards, according to Bryan Cook, director of higher education policy at the Urban Institute.

"It's possible the numbers may not be as stark as people think," Cook said of how this year's changes will be reflected in next year's freshman class. "What may mitigate the decline is schools trying to work around this."

However, research also shows that when states end affirmative action, the class makeup significantly shifts, added Elise Colin, a research analyst at the Urban Institute.

After the University of California eliminated affirmative action in 1996, the share of underrepresented groups fell 12% in the years that followed. When the University of Michigan banned race-conscious admissions, Black undergraduate enrollment at the school dropped by nearly half from 2006 to 2021, according to the Urban Institute.

"Even when they tried to use other methods to increase diversity, that didn't make up from the loss of affirmative action," Colin said.

Advocates have warned that the ability to maintain racial and ethnic diversity would likely be under pressure and it may be a while before the impact of the high court's ruling against affirmative action is entirely clear.

"Some institutions in the face of the Supreme Court's decision, which has created a lot of uncertainty, are being incredibly thoughtful in how they can achieve their mission. But it requires real commitment," McClellan said.

The financial aid factor

For many families, the price tag is the most significant sticking point when it comes to college access. With financial aid awards delayed this year due to the rollout of the new Free Application for Federal Student Aid, or FAFSA, high school seniors are under even more pressure to decide on college with less time to weigh the financial implications.

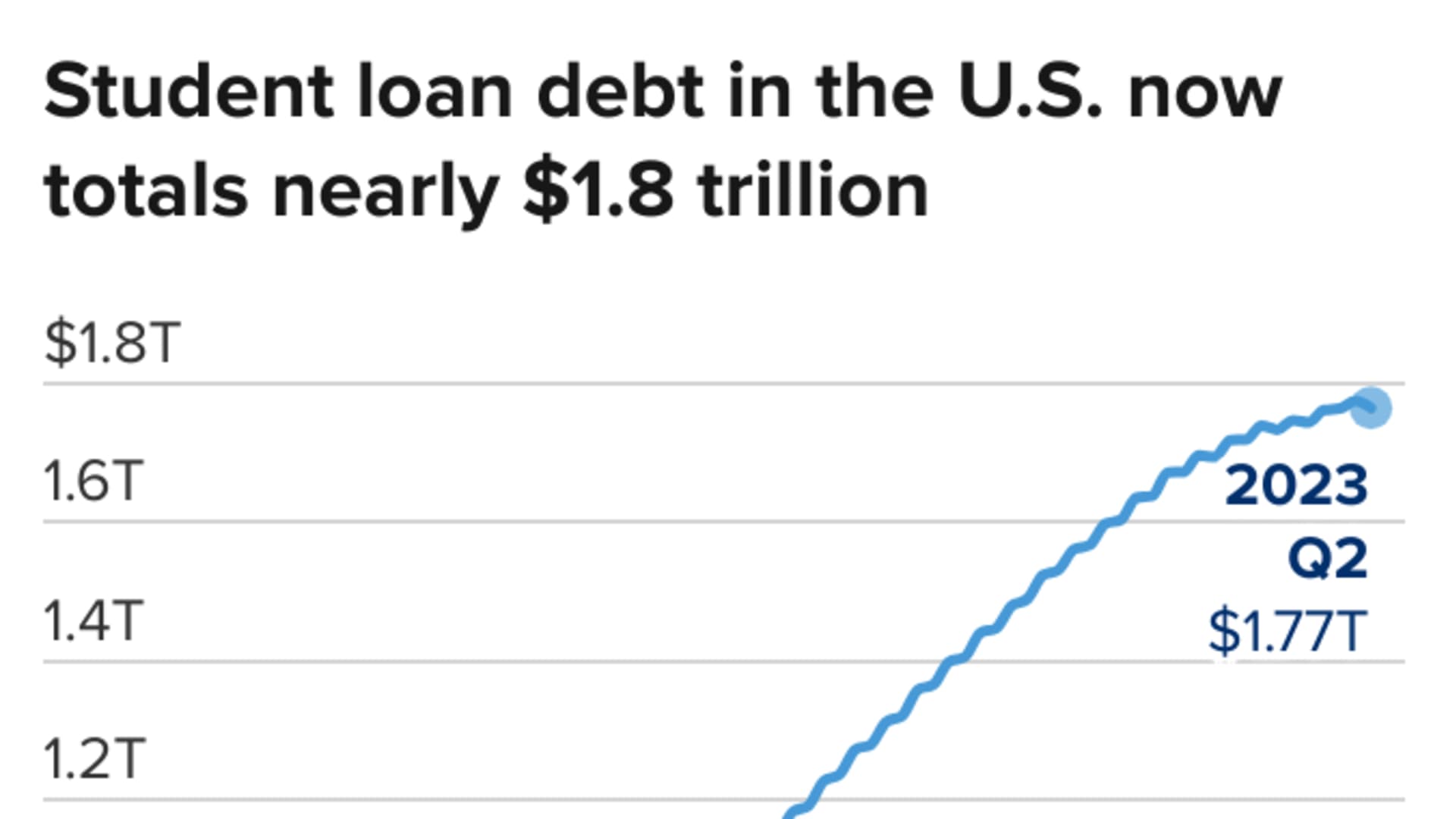

Meanwhile, would-be college students have been looking more closely at the return on investment and the growing student loan balances that often go hand in hand with a degree, other reports also show.

The costs associated with an undergraduate education have greatly outpaced the general cost of living over the past few decades, leading to the spike in student loan debt, according to a recent report by Wells Fargo.

The share of Black households that have student debt is 14 percentage points above the comparable share among all families, the Wells Fargo report found. Black households also tend to borrow more than other households to finance a higher education.

And because of historic racial and economic inequities, Black student loan borrowers struggle to repay their debt more than their white peers.

"This becomes another barrier for students who are underrepresented and under-resourced," McClellan said.

In some ways, the student loan crisis has overshadowed higher education's proven success, said Liz Cheron, CEO of the Coalition for College, which aims to promote college access.

However, for students going through the college admissions process this year, these are hefty challenges to navigate, she noted.

"The reality for students and families is that this is outside their control," she said. "We have to trust that colleges and universities are working as hard as they can to innovate and create solutions in a more limited environment."

"I'm really hopeful with this challenge that the collaboration and innovation and creativity really will allow for us to encourage diverse student audiences to pursue higher education," she added.

Don't miss these stories from CNBC PRO:

- Forget 'FANG' and 'Magnificent 7,' the new hot portfolio is 'MnM,' says Raymond James

- Walmart just split its stock. History shows what will happen next with the megacap

- Alibaba, ASML and more: Jefferies reveals its 'highest-conviction' stocks to buy — and one has 118% upside

- Tesla is one of the most oversold stocks in the S&P 500 and could be due for a bounce