Working is not working out for a record number of us.

According to federal data, the number of people quitting has never been higher in the 20 years the Bureau of Labor Statistics has been tracking folks who walk away from a job.

For many, whether 30-something, or 60-something, the decision comes after a pandemic-induced rethink of life goals. For far too many women it has been a resignation made out of familial necessity, as many employers give far too little practical support to mothers juggling work with running the home front as well.

Get Boston local news, weather forecasts, lifestyle and entertainment stories to your inbox. Sign up for NBC Boston’s newsletters.

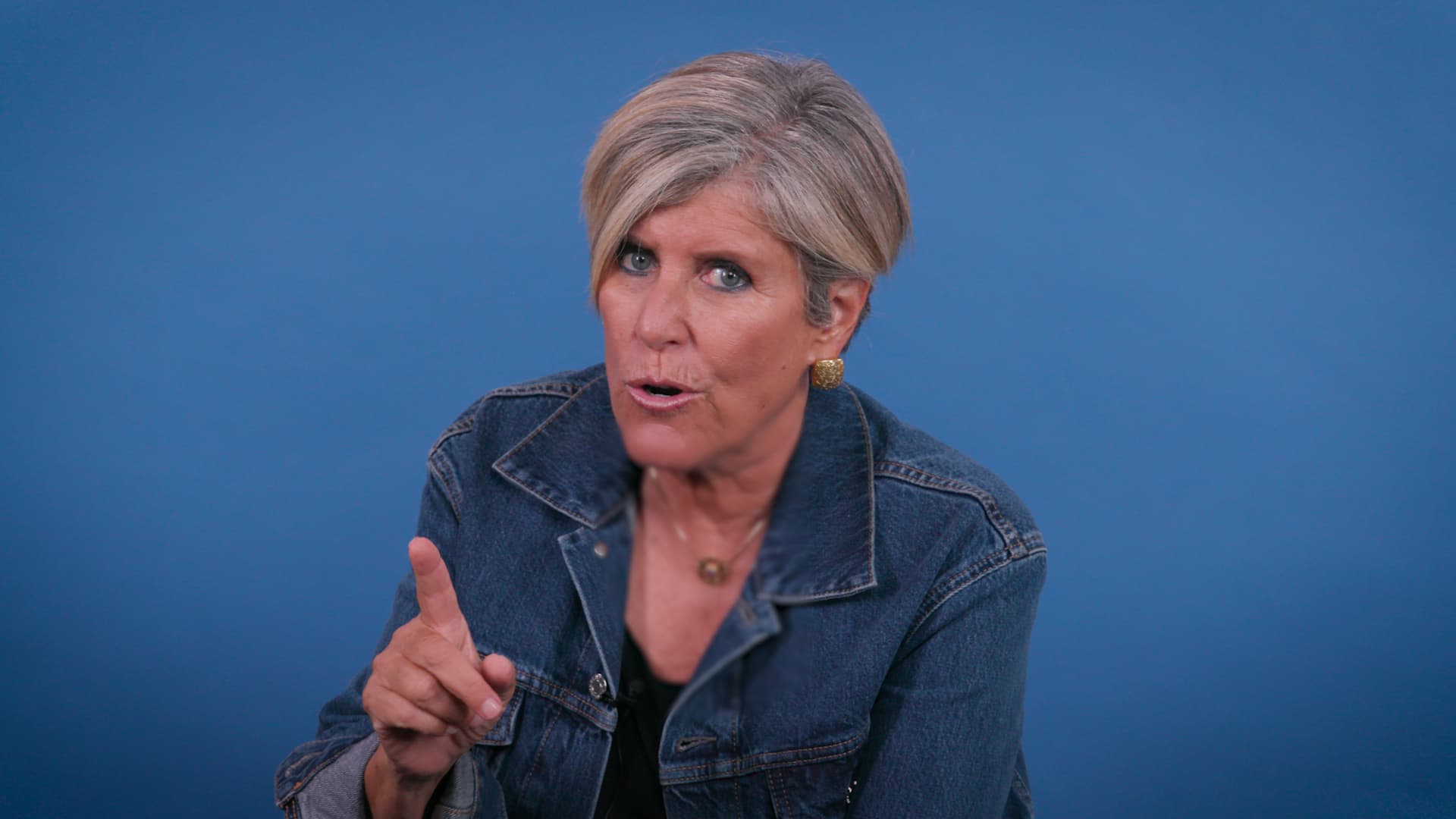

I totally get what is going on. I am not here to deliver a Suze smackdown that quitting your job is wrong. Or too risky. That is for you to decide. But I do hope you will make that choice after careful consideration.

Here's a short list of questions to ask yourself.

Money Report

Can you make the job you have work for you better? Take the time to think through what really isn't working for you at your current job. If it's a long list, or just too draining/toxic, then walking might be the smart move. I will never tell someone to stay where they aren't valued. Or if they feel compelled to focus more on family.

But if it's a job or a workplace you could stay happy at with a few tweaks, why wouldn't you discuss those changes with your manager? If you have rocked work, and you know you are a valuable employee, it seems reasonable that a sane manager would be willing to discuss tweaks with you. It sure doesn't hurt to ask.

It's your manager who's the problem? Gotcha. That's neither fun nor easy to navigate. But I still wouldn't just walk out. Are there different managers/groups you think would be a good fit for you? If you're on the edge of quitting anyway, you don't need to worry much about your current manager getting annoyed.

What's your confidence level on an easy reentry more on your terms? If you're quitting because your boss has ended work-from-home, and you are so not going back to that grind, I want you to do some advance planning on your next job. Hit up your LinkedIn network, or job boards in your field to get a sense of whether there really are employers out there who are comfortable with remote work.

Can you cover health insurance premiums and out-of-pocket costs? Okay, this is my one financial line in the sand: you must continue to have health insurance coverage. It is irresponsible to go without.

You may be able to stay on an ex-employer's health plan for 18 months, but you will be responsible for the entire premium cost. You may find it makes more financial sense to purchase a plan directly through the federal insurance marketplace (healthcare.gov).

And I want you to focus on more than the monthly premium cost. Whatever policy you have, check what your potential annual maximum out-of-pocket cost can be. I sure hope you have at least that much set aside in an emergency savings fund.

More from Invest in You:

If you don't get a 5% raise this year, you aren't necessarily taking a pay cut due to inflation. Here's why

The 'Great Resignation' is burning out those who stay. Here's what they can do

How to negotiate the salary for your first job offer

Can your finances cover double the amount of time you intend to take off? For those of you who are not ready for full-on retirement, I imagine you have an idea of how much time you plan to take off once you resign. Whether that's one months or six months, I want you to consider what would happen if you were not earning a paycheck for at least twice that long. For example, if you want to take off two months, what happens if you're out of the market for four months? Can you still pay the bills?

And that's me being conservative. If you quit your job next month and two months later we're in a recession, you may not be able to land a new job for many months.

I do not for one minute doubt that you deserve this time off. I am not here to tell you that you can't afford it. Rather, I am asking you to think through what sort of resignation/time-off you can afford. And I want you to consider the "what if" that after you resign, and take some time to breath, the job market may not be strong when you're ready to return. Will you be able to support yourself for at least a few more months than originally planned? Will you be willing to accept a job that might be lateral, or perhaps a step back, if that's the way to restart?

Are you financially ready to retire? For those of you who are contemplating moving up your check-out date from the work force, the old retirement rules are still to be followed.

It still makes the most sense for the highest earner in a household to wait until age 70 to start collecting Social Security. If you're in your 60s and contemplating collecting Social Security, I would encourage you to sit down with a financial planner to run through some scenarios. Pulling money from retirement savings can be smarter than starting Social Security before age 70, especially if you are in good health. (The odds of living into your 90s are higher than you think, which increases the value of waiting to collect Social Security.)

Still ready to quit? Nail your exit. You get one chance to make a graceful, professional exit. Doesn't matter how bad you have been treated. Or how you feel about your manager. This is about you. If you decide to quit your job, I want you to be proud of how you navigated the process.

Before you say a word to anyone, I want you to find some quiet time to envision it is six months from today, and you are replaying how you quit your job. What would the exact words you said to your manager be? What do you want your colleagues to know? Gonna show up for the HR exit interview? Okay, what's the constructive feedback you want to deliver?

Leaving on a high note will feel so good today and tomorrow. And even though it's not on your radar right now, whenever you are ready for the next job, you won't need to navigate around burned bridges.

—By Suze Orman, co-founder and CSO of Securesave.com

SIGN UP: Money 101 is an 8-week learning course to financial freedom, delivered weekly to your inbox.

CHECK OUT: Meet the ‘semi-rich’: Millions of high-income Americans may not feel wealthy but are, says ‘The 9.9 percent’ author via Grow with Acorns+CNBC

Disclosure: NBCUniversal and Comcast Ventures are investors in Acorns.