Stocks fell Wednesday as investors took a breather from last week's market rally, and weighed Federal Reserve Chair Jerome Powell's latest comments on inflation.

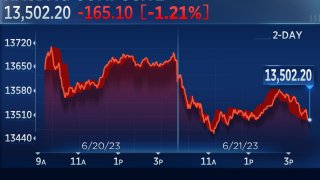

The Dow Jones Industrial Average was lower by 102.35 points, or 0.30%, to 33,951.52. The S&P 500 dropped 0.52% to 4,365.69, while the Nasdaq Composite slid 1.21% to 13,502.20. It was the third consecutive day of losses for the three indexes.

Some major tech stocks that enjoyed an extraordinary run because of enthusiasm around artificial intelligence pulled back. Amazon shares dropped about 0.8% after the Federal Trade Commission on Wednesday sued the online retailer. The agency alleged that Amazon fooled millions of shoppers into signing up for Prime, and then hindered their attempts to cancel. Nvidia, which is up nearly 200% this year, slid 1.7%. Shares of Google-parent Alphabet and Netflix were each down by more than 2%.

Get Boston local news, weather forecasts, lifestyle and entertainment stories to your inbox. Sign up for NBC Boston’s newsletters.

Elsewhere, FedEx shares fell more than 2% a day after the shipping giant posted weaker-than-expected revenue for its most recent quarter. Winnebago shares slid nearly 1.3% after the motorhome maker missed third-quarter revenue estimates.

Powell said Wednesday that more rate hikes are likely ahead as the central bank tries to combat inflation. Those comments come after the conclusion of last week's meeting when the central bank held off from raising rates after 10 straight consecutive hikes. However, officials indicated there could be two more quarter-percentage point moves on the horizon this year.

"Nearly all FOMC participants expect that it will be appropriate to raise interest rates somewhat further by the end of the year," Powell said in prepared remarks for the House Financial Services Committee.

Money Report

Stocks are taking a pause from the exuberance of the recent rally. Last week, the S&P 500 hit its highest level since April 2022 and posted its fifth consecutive positive week.

"Over the last several weeks, they've done nothing but go up, which has been a relief, and it looks like the Fed speakers this week are really going to focus on talking about, they're going to continue to raise rates," Bokeh Capital Partners founder Kim Forrest said.

"And I think that has given especially some of the higher flying names that are dependent on growth a pause, which is bringing down the market," Forrest said.

— CNBC's Jeff Cox contributed to this report.

Lee este artículo en español aquí.

Stocks close lower Wednesday

Stocks closed lower Wednesday.

The Dow Jones Industrial Average was lower by 102.35 points, or 0.30%, to 33,951.52. The S&P 500 dropped 0.52% to 4,365.69, while the Nasdaq Composite slid 1.21% to 13,502.20.

— Sarah Min

WTI crude on track for best month since October

West Texas Intermediate crude settled up 1.88% at $72.53 per barrel, and also hit its highest level since June 8 during the trading session.

The U.S. oil benchmark is now up 6.52% for the month, on track for its best month since October 2022.

The gains for oil this month have come despite concerns about economic growth in China and Federal Reserve officials signaling that more rate hikes are likely coming in the U.S.

— Jesse Pound, Gina Francolla

Agricultural commodities and their ETFs posting solid monthly returns in June

Wheat futures are almost 22% higher in June, on track to advance for the first in nine months and log their best month since Russia invaded Ukraine in February 2022. September wheat contracts have reached their highest absolute level since mid-April.

Meanwhile, robusta coffee prices have climbed to the highest since the summer of 2011.

The Teucrium Wheat Fund is almost 5% higher Wednesday, and ahead about 19% in one month, while the

Invesco DB Agriculture Fund is up 1% Wednesday and almost 11% year to date.

The top commodities in the Invesco ETF are sugar (up almost 30% in 2023), live cattle, cocoa, soybeans, coffee, corn, lean hogs, wheat, feeder cattle and cotton.

— Scott Schnipper, Gina Francolla

Expect a pullback that's as 'equally impressive' as the recent rally, BTIG says

Investors should expect a big pullback from the recent artificial intelligence-fueled rally, BTIG's Jonathan Krinsky said.

"Parabolic moves rarely end with calm or gradual consolidations; they often end with an equal and opposite reaction to the impulsive move," the chief market technician at BTIG wrote on Wednesday.

"We view the move in the Nasdaq and FANGMAN type of names from late May as parabolic, and therefore suspect the unwind will be equally impressive," he added.

— Sarah Min

Where the major averages stand in the final hour of trading

Here are the major averages shortly into the final hour of trading.

- The Dow Jones Industrial Average is lower by 13 points, or 0.05%

- The S&P 500 is down 0.27%

- The Nasdaq Composite is off by 0.85%

— Sarah Min

JPMorgan says public sector-focused software stock is worth buying

Investors should be following Tyler Technologies, a domestic software provider focused on the public sector, according to JPMorgan.

Analyst Alexei Gogolev initiated coverage of the stock at overweight. His $472 price target shows a potential upside of 20.5% over Tuesday's close. That would imply a continuation of its recent rally, with shares up 21.4% so far this year.

"We like Tyler's investment case, as the company is a clear market leader in the space (with singular focus on the public sector, meaning that it has the broadest range of public sector solutions)," he said in a note to clients Wednesday. "Tyler already has a large install base that it is likely to leverage, guiding that most of the growth will come from up-sell and cross-sell opportunities."

— Alex Harring

Fed's Bostic calls for 'play-it-by-ear' approach on rates

Atlanta Federal Reserve President Raphael Bostic said Wednesday the central bank can stop raising interest rates as it gauges the impact of the 10 previous hikes.

"I think we are in a place where we should let the hard work the Committee has already done work its way through the economy and see if it continues to bring inflation closer to our goal," Bostic said in an essay.

He labeled his policy outlook as a "play-it-by-ear approach" in which policymakers can watch for impacts of policy tightening and then decide at each individual meeting whether to hike, hold or cut.

Bostic is nonvoting member of the rate-setting Federal Open Market Committee this year.

—Jeff Cox

Home construction ETF hits fresh 52-week high

The iShares US Home Construction ETF (ITB) was trading in positive territory, and headed for a second straight day of gains. In fact, the ETF is on pace for its fourth straight weekly gain, which would be its longest such rally since a six-week streak ended in late July 2022.

Here are some other notable milestones:

- ITB is up 11.7% in June, on pace for its third monthly gain in the past four, and its best month since January when it gained 14.79%.

- ITB hit a fresh 52-week high today, its highest level since Jan. 5, 2022. It's trading just 2% from its all-time high of 83.43 reached Dec. 13, 2021.

- ITB is up more than 16% this quarter, on pace for its third quarterly gain in a row for the first time since gaining ground in each quarter of 2019.

- ITB components hitting fresh 52-week highs today include PulteGroup, Builders FirstSource, Lennox International and Owens Corning.

- This month's leaders include Beacon Roofing, TopBuild, Installed Building Products and American Woodmark, all up more than 20% month to date.

— Nick Wells, Sarah Min

Google accuses Microsoft of unfair practices in Azure cloud unit

Google, which has spent years defending itself against claims of monopolistic behavior across the U.S. and Europe, is going public with its own complaint of anti-competitive practices by longtime rival Microsoft.

In a letter to the Federal Trade Commission on Wednesday, Google alleged that Microsoft uses unfair licensing terms to "lock in clients" to exert control over the cloud-computing market.

Shares of Google-parent Alphabet were last down about 2%.

— Rohan Goswami, Jennifer Elias

Bank of America lowers price target on Harley-Davidson, but sticks with buy rating

Bank of America is sticking with a buy rating for Harley-Davidson, even though the motorcycle stock has sat on the sidelines during this year's rally.

Analyst Robert Ohmes lowered his price target on the stock to $45 per share from $55, but the new target still represents about 33% upside for Harley-Davidson. The company should see earnings grow next year as sales shift to higher margin vehicles, Ohmes said in a note to clients.

"We believe near-term pressure is partially offset by a potential C24 pivot to higher margin Trikes in order to satisfy demand for an aging boomer population (which we believe are 2x more likely than GenX to buy a Harley in peak riding years). We also see potential long-term support from a shift in dealer inventory away from Sportsters and a more favorable rate/inflationary environment,"

Shares of Harley-Davidson are down about 18% year to date.

— Jesse Pound

Wolfe Research says the recent rally 'may not be over'

Wolfe Research maintained its bearish stance on equities, but said the recent rally may have some ways yet to go — possibly through to late July.

"We're not changing our bearish call — especially with the S&P 500 trading close to 19x and the VIX with a 13- handle on it! Further, after this year's strong run, stocks appear vulnerable to even a little bit of bad news," Chris Senyek said to clients in a Wednesday note.

"However, following Fed Chair Powell's dovish tone last week, our sense is that a definitive downside catalyst may not emerge until the next Fed meeting on July 26th and/or until incoming economic data begins to turn meaningfully downward this fall," Senyek wrote.

— Sarah Min

See the stocks making the biggest midday moves

These are the stocks making some of the biggest midday moves:

- Amazon — Shares of the online retail giant slumped 1.3% after the Federal Trade Commission said it was suing Amazon over allegations of deceptively pushing customers to sign up for Prime and frustrating their efforts to cancel.

- FedEx — The delivery company fell 1.7% after quarterly revenue missed expectations and announced CFO Mike Lenz would retire on July 31. The company posted revenue at $21.93 billion, below the consensus estimate of $22.67 billion, according to Refinitiv. Adjusted earnings were better than expected at $4.94 per share against the anticipated $4.89, while forward guidance was around flat.

- Advanced Micro Devices — Shares of the chipmaker pulled back nearly 5%, on track for their biggest intraday loss in two weeks. AMD has had a huge run this year amid optimism towards artificial intelligence. The stock is still up more than 70%.

— Alex Harring

Brazilian oil stock's valuation and lessening risks could help extend rally, Goldman Sachs says

Petrobras is still worth buying despite the recent jump in share price because of its still-attractive valuation and diminishing tail risks, Goldman Sachs said.

Analyst Bruno Amorim upgraded the Brazilian petroleum company to buy. His price target of $18.10 implies an upside of 27.2% from Tuesday's close, meaning the stock's rally could go further.

"We believe the recent stock rally reflects greater visibility on what will be the new management's approach on fuel pricing policy and capital allocation for the current cycle," he said in a note to clients Tuesday. "Although we acknowledge visibility still remains limited, we believe those announcements at least partially reduced the possibility of an eventual worst case scenario that was expected by some investors."

CNBC Pro subscribers can read more here.

— Alex Harring

Energy is the biggest advancer in the S&P 500

Energy was the biggest advancer in the S&P 500 during midday trading. The sector was higher by 1.6%, buoyed by stabilizing oil prices.

Baker Hughes was last trading 3.3% higher, while APA and Halliburton were up by roughly 3%. Schlumberger N.V. rose 2.2%.

— Sarah Min

Powell sees economy as 'very strong' and cites 'progress' in inflation fight

Fed Chairman Jerome Powell gave high marks to the U.S. economy, which has held steady despite the central bank's efforts to slow growth and bring down inflation.

"The economy is very strong," Powell said Wednesday morning during one of his exchanges with House Financial Services Committee members. "What's driving it now is just a very strong labor market."

The chair noted that the Fed considers inflation fighting to be its top priorities, and said, "We have quite a ways to go, but we're making progress."

Even with 5 percentage points worth of rate hikes since March 2022, Powell said, "Our recovery is by far the strongest of many countries."

—Jeff Cox

BMO says A.I. should boost Adobe

Artificial intelligence should help Adobe get new customers, keep them and get them to spend more, according to BMO Capital Markets.

Analyst Keith Bachman upgraded the software stock to outperform from market perform and raised his price target by $70 to $570. His new price target implies shares could rally 17.3% over the next year.

"We believe that ADBE can capture price/mix, as well as new users, through generative AI," he said in a note to clients Wednesday.

Shares slid more than 1% in Wednesday's session.

CNBC Pro subscribers can read the full story here.

— Alex Harring

Get less bullish on Tesla following rally, Barclays says

Investors should take profit after Tesla's recent outperformance, Barclays said.

"We believe the stock's recent rally can be best explained by the market's current AI-driven thematic trade, as well as excitement over recent announcements to open the TSLA Supercharger network to other brands," analyst Dan Levy said in a note to clients Wednesday. "Yet while we aren't surprised that the stock has participated in the rally, we believe it is prudent to move to the sidelines."

CNBC Pro subscribers can click here to read more on where Levy thinks the stock will go next.

— Alex Harring

Dollar Tree pops after reaffirming fiscal Q2 guidance

Shares of Dollar Tree popped more than 3% after the discount retailer reiterated its fiscal second-quarter 2023 earnings guidance. The company expected quarterly earnings between 79 cents per share and 89 cents per share. It also maintained its full-year outlook for the fiscal year.

— Fred Imbert

PulteGroup trades at all-time highs going back to 1972

PulteGroup is trading at all-time highs going back to its initial public offering in 1972. The homebuilder stock was buoyed this week following a stronger-than-expected housing report. Week to date, PulteGroup is higher by 2.6%, while the S&P 500 is lower by 1%.

Here are 13 S&P 500 stocks that reached fresh 52-week highs:

- PulteGroup trading at all-time highs back to its IPO in 1972

- Royal Caribbean trading at levels not seen since November 2021

- AmerisourceBergen Corporation trading at all-time highs back to its IPO in April 1995

- Cardinal Health trading at all-time highs back to its IPO in 1983

- McKesson trading all-time highs back through our history to 1983

- Fastenal trading at levels not seen since May 2022

- Howmet Aerospace trading at all-time highs back to its Alcoa spinoff in Nov 2016

- Quanta Services trading at all-time highs back to its IPO in February 1998

- Snap-On trading at all-time high levels back through our history to 1972

- TransDigm Group trading at all-time high levels since its IPO in March 2006

- Martin Marietta trading at levels not seen since January 2022

- Vulcan Materials trading at levels not seen since January 2022

- CoStar Group trading at levels not seen since November 2021

— Sarah Min, Chris Hayes

Amazon steered consumers to sign up for Prime without their permission, FTC says

The Federal Trade Commission sued online retail behemoth Amazon on Wednesday over alleged usage of deceptive design tactics.

The FTC say Amazon knowingly pushed users to sign up for the company's Prime service and actively discouraged their efforts to cancel. The lawsuit stems from a March 2021 investigation into Amazon's processes for customer sign-ups and membership cancelations.

"Amazon tricked and trapped people into recurring subscriptions without their consent, not only frustrating users but also costing them significant money," FTC Chair Lina Khan said.

— Brian Evans

AllianceBernstein says investors are now 'extremely bullish,' urges caution ahead

AllianceBernstein says investor sentiment has reached "extremely bullish" levels, and urged traders take caution in the near term. The firm said its Composite Sentiment Indicator (CSI) crossed the key +1 standard deviation level for the first time since November 2019.

"We view extreme bullish sentiment as a tactical signal for caution as global equity returns have historically been negative, on average, over the 4-6 weeks following a sell signal," the firm's Mark Diver wrote Tuesday.

— Sarah Min

Stocks open lower Wednesday

Stocks opened lower Wednesday.

The Dow Jones Industrial Average dropped 116 points, or 0.34%. The S&P 500 declined 0.36%, while the Nasdaq Composite also slid 0.34%.

— Sarah Min

Silver miners down 15%+ in second quarter and on pace for worst quarter in a year

Silver mining stocks have had a tough second quarter, falling 15.4%, and are down 3.7% so far in June alone, on pace for their third straight monthly decline. Silvercrest Metals, MAG Silver and First Majestic Silver are all down almost 7% or more in June alone.

Silver miners are also on track for their first down quarter in three, and the worst quarterly slump since the second quarter of 2022, when the Global X Silver Miners ETF tumbled 29%. Coeur Mining, First Majestic Silver and Hecla Mining are all lower by 20% or more so far this quarter.

Elsewhere in metals land, July platinum futures are trading at their lowest since mid-March. Silver and aluminum prices are at their weakest since late May, while nickel is at an eight-day bottom.

— Gina Francolla, Scott Schnipper

Stocks making the biggest moves premarket

Check out some of the companies making headlines in premarket trading.

MicroStrategy — The cloud services firm with exposure to bitcoin added 2.9% in premarket trading, following other names higher. Shares have climbed more than 121% so far in 2023 and 8.7% over the past month.

Tesla — Shares of the electric vehicle giant added 1.2% even after a downgrade from Barclays to equal weight from overweight. The bank warned investors that it may be prudent to "to move to the sidelines" after its recent rally. Tesla shares are up more than 52% over the past month.

Winnebago Industries — The motorhome manufacturer slipped 4.7% after quarterly results. The company reported an adjusted $2.13 per share against estimates of $1.78, according to FactSet. However, the firm also reported a 38.2% decline in revenue to $900.8 million, which executives attributed largely to a more challenging RV market and steeper discounts.

Read the full list here.

— Brian Evans

Powell confirms more interest rate hikes likely

Federal Reserve Chairman Jerome Powell on Wednesday said he and his colleagues expect more interest rate increases ahead as inflation is still too high.

"Inflation pressures continue to run high, and the process of getting inflation back down to 2% has a long way to go," he said in prepared remarks for a hearing before the House Financial Services Committee.

Powell noted that "nearly all" policymakers figure additional hikes will be needed to bring inflation closer in line to the Fed's 2% target.

—Jeff Cox

Winnebago Industries slips after quarterly results

Shares of motorhome maker Winnebago Industries fell 5.4% in premarket trading after the firm reported quarterly results.

The company posted an adjusted $2.13 per share against FactSet estimates of $1.78. The company noted a staggering 38.2% decline in revenue for the quarter to $900.8 million, with executives noting the decline was tied to a more challenging RV market as well as steeper discounts to spur sales.

"Our diverse portfolio of premium brands across the outdoor recreation industry continues to drive resiliency in our consolidated results, as top-line declines in our RV segments were offset by robust profitability in Towable RVs and continued growth in our Marine businesses," chief executive Michael Happe said.

— Brian Evans

Spotify rises more than 1% before the bell following Wolfe upgrade

Spotify added 1.7% in premarket trading after Wolfe Research got off the sidelines on the music streaming platform's stock.

Analyst Zach Morrissey upgraded the stock to outperform from peer perform. His price target of $190 implies the stock could rally 21.2% over Tuesday's close.

"From a business standpoint, there are no doubts that SPOT has significant lead over competition in the music streaming space both in terms of product capabilities and scale," he said in a note to clients Tuesday. "The secular tailwinds driving SPOT's music business (in terms of user growth and engagement) still have plenty of runway, specifically in emerging markets."

CNBC Pro subscribers can read the full story here.

— Alex Harring

AllianceBernstein says Oracle could be a 'mini-Microsoft'

AllianceBernstein expects Oracle could be a "mini-Microsoft," saying there are some parallels between the two tech giants as Oracle transitions its business to cloud. That could spell a "real opportunity" in the stock.

"At a high-level, In 2015 Microsoft's story had three key pillars and one could argue Oracle has 3 similar pillars: 1) the Office Cloud Transition — Oracle is in the early days of an ERP Cloud migration; 2) a nascent growth opportunity in Azure — Oracle has OCI Gen 2; and 3) the Windows and Server& Tools Cash machine — Oracle has its Database (with cloud optionality)," Mark L. Moerdler wrote on Wednesday.

"So while we are not ready to say, Oracle is the next Microsoft, Oracle's present set-up does have some similarities that are worth noting, especially as investors consider the opportunity from here," Moerdler wrote. "Hence, the analogy — Oracle could be a mini-Microsoft."

— Sarah Min

Industrial stocks been 'impressive' throughout 2023, Strategas says

The S&P 500 is higher by 5% so far in June, despite the past two days' downdraft, but the S&P 500 Industrials Index is higher by 8% this month.

"Away from the AI frenzy, it's the Industrials that have remained most impressive all year ... an expanding new high list for the group reflects this, with recent breakouts for names like PH, ETN, IR, etc.," Chris Verrone, Strategas chief of technical strategy and macro research, wrote to clients in a Tuesday report.

"There are some short-term overbought conditions here (see Friday's reversals), but summer pullbacks in good trends are generally buyable."

— Scott Schnipper

U.S. Treasury yields rise as investors await comments from Fed Chair Powell

U.S. Treasury yields climbed on Wednesday as various Fed officials are due to make remarks, including Fed Chairman Jerome Powell, who is set to testify before the House Financial Services Committee. Investors will be looking to the comments for more clarity about policymakers' expectations for interest rates and the economy.

At 4:21 a.m. ET, the yield on the 10-year Treasury was up by over two basis points to 3.7499%. The yield on the 2-year Treasury was trading more than two basis points higher at 4.7238%.

Yields and prices move in opposite directions and one basis point equals 0.01%.

— Sophie Kiderlin

Europe stocks lower

European stocks continued the week's negative trajectory early Wednesday, with the benchmark Stoxx 600 index down 0.17% at 8:45 a.m. London time.

The U.K.'s FTSE 100 fell 0.38% after inflation data came in above expectations, while France's CAC 40 was down 0.25%. Germany's DAX managed a 0.1% gain.

— Jenni Reid

Hong Kong shares of Alibaba tumble over 3% on Wednesday in light of leadership shuffle

Hong Kong-listed shares of Chinese tech giant Alibaba fell over 3% on Wednesday, extending its losses and mirroring similar moves in its U.S.-listed stock overnight.

Alibaba's U.S. stock slid 4.53% on Tuesday after the announcement that Eddie Wu, one of the firm's co-founders, will replace CEO Daniel Zhang — who is stepping down to focus on Alibaba's cloud business.

Earlier in March, Alibaba said it was splitting its firm into six business groups.

— Lim Hui Jie, Sarah Min

South Korea factory gate prices climb 0.3% in May

South Korea's producer prices index for May rose 0.6% year-on-year, lower than April's figure of 1.6%.

This puts the index at 120.14, slightly lower than the 120.5 recorded in April.

The PPI measures the average movements of prices received by domestic producers for goods and services sold.

The Korean won weakened by 0.12% after the announcement to trade at 1,289.67 against the dollar.

— Lim Hui Jie

Business sentiment among large Japanese manufacturers rises for second straight month: Reuters poll

Business sentiment among large Japanese manufacturers remained in positive territory for a second-straight month in May, according to the Reuters tankan survey.

The manufacturing index rose to +8, higher than the +6 recorded in May. Separately, the non-manufacturing index dipped slightly to +24, hovering near the year high of +25 recorded in April.

The survey rates the relative level of general business conditions, with a level above zero indicating improving conditions and a level below zero indicating worsening conditions.

The Reuters tankan survey is a monthly survey of leading Japanese companies, and the monthly figures are designed to provide early indications of the Bank of Japan's quarterly tankan survey.

— Lim Hui Jie

Prospect of two more Fed rate hikes bodes well for depositors, Stephens says

The Federal Reserve indicated that it has two more rate hikes this year – and that's great news for savers at online banks, according to Stephens.

"Following last week's Fed commentary, which had a pause for this month but set up for another two rate increases this year, we expect online bank rates will continue to climb through the year," wrote analyst Vincent Caintic.

Most recently, Capital One boosted the annual percentage yield on its high-yield savings account to 4.10%, an increase of 10 basis points from the prior week, Caintic found. Synchrony Financial raised the yield on its one-year CD by 5 basis points from the previous week, bringing it to 4.8%.

Bread Financial remains the standout in Stephens' field of coverage, with an APY of 5.25% on its 12-month CD and 4.75% on its savings account.

—Darla Mercado, Michael Bloom

Bitcoin climbs higher amid a wave of institutional interest in crypto

Cryptocurrencies began climbing earlier in the day after traders got another indication that despite crypto prices being stuck in a narrow range this quarter, financial incumbents are fully committed to pursuing crypto in one form or another.

Bitcoin was up by about 6% Tuesday evening and trading above the $28,000 level for the first time in more than a month, according to Coin Metrics. Ether advanced more than 3% to trade above $1,700.

BlackRock, Citadel, Charles Schwab and Fidelity have all made crypto news headlines in the past week. On Tuesday evening WisdomTree jumped into the mix when it filed for a spot bitcoin ETF. The U.S. never green lit a spot bitcoin ETF, though several bitcoin futures ETFs have been allowed to move forward.

— Tanaya Macheel

FedEx falls in extended trading following quarterly results

Shares of FedEx dipped 3% after hours, following a mixed financial report for its most recent quarter that included weaker-than-expected revenue but better-than-expected earnings, and echoing trends from recent quarters like weakening demand and benefits from cost cuts.

The shipping company posted earnings of $4.94 per share for the fourth quarter on revenues of $21.93 billion. Analysts had expected $4.89 per share on revenues of $22.67 billion, according to Refinitiv.

FedEx posted its sixth consecutive decline in Ground volumes, a 7% slump in volumes in its Express unit and a 3% drop year-over-year in its pricing — all of which led to its revenue miss.

Earnings projections for the full year are between $16.50 and $18.50. The midpoint of $17.50 is well below consensus.

— Tanaya Macheel, Robert Hum

Stock futures open near flat

Stock futures were little changed to begin trading on Tuesday night.

Futures tied to the Dow Jones Industrial Average slipped 17 points, or 0.05%. S&P 500 futures inched down by 0.05% and Nasdaq 100 futures lost 0.03%.

Earlier on Tuesday, stocks closed lower for the second trading day in a row. The Dow fell 245.25 points, or 0.72%, to 34,053.87. The S&P 500 slid 0.47% to 4,388.71, and the Nasdaq Composite lost 0.16% to 13,667.29.

— Tanaya Macheel