This story is part of CNBC Make It's Millennial Money series, which details how people around the world earn, spend and save their money.

Shonnita Leslie always had a passion for education. But by the time she earned her bachelor's degree in sociology and master's of education in psychology with a concentration in school counseling in 2009, her student loan debt had ballooned to around $101,000 and she was struggling to make payments.

"Because I graduated during the Great Recession, it was really hard for me to get on my feet and find my first stable job working full-time to make enough to even pay the minimum," she tells CNBC Make It.

Leslie was eventually able to find work as a certified school counselor at a public school in Connecticut, where she's from, earning enough to make her minimum student loan payments.

Get Boston local news, weather forecasts, lifestyle and entertainment stories to your inbox. Sign up for NBC Boston’s newsletters.

However, she wanted to be able to pay off her debt more quickly. She ended up moving to Houston, Texas, where she earns $65,000 between her full-time role as a program manager at a university, and part-time work as a DoorDash driver and freelance writer.

"I was welcomed with open arms here in Houston," she says. "I absolutely love it here."

Here's how she balances multiple jobs while continuing to pay down her student loans.

Money Report

Choosing a career in education: 'This is the work that I love'

Growing up in Connecticut, Leslie was surrounded by family members who were educators, which influenced her to pursue a career in the field.

However, she didn't factor in how much she would be able to earn working in education, compared with the student loan debt she would need to take on in order to gain the proper credentials, she says.

"I was always following my passion instead of really thinking logically about the career field versus the income," she says. "Education is one of those few fields where you need a high level of education versus the amount of money that you will be compensated for."

Although Leslie has been chipping away at her student loan debt for about 15 years, she says it's been worth it in order to pursue her passion.

"This is the work that I love," she says. "I love giving people information that I didn't have."

Qualifying for student loan forgiveness: 'I was completely relieved'

At the end of the 2017 school year, Leslie's district underwent massive layoffs and her school ended up closing, prompting her to move to Houston. She had family in Texas and knew the cost of living would be cheaper than in Connecticut.

She initially landed a job at a charter school. A year later, she was offered a job as a program manager at a university, which she still holds today. She continued repaying her student loans, but her payments only went toward the accumulated interest. Despite making consistent payments, her principal balance remained at $101,000.

Luckily, Leslie's years as a school counselor had set her on track to qualify for Public Service Loan Forgiveness, and continuing to work in public education put her even closer every year.

In 2022, she finally had $60,000 in federal loans forgiven through the PSLF program. "I was completely relieved," she says.

Earning thousands delivering for DoorDash

However, since Leslie had private student loans that didn't qualify for forgiveness, she still had a balance of around $40,000, so she decided to pick up a part-time job as a DoorDash delivery driver.

"I just wasn't making enough money to make a dent in my debt and I knew I could do it a lot quicker if I had something like DoorDash to help compensate my full-time earnings," she says.

Over the course of five years, from 2018 to 2023, Leslie earned around $72,000 total working part-time as a DoorDash delivery driver.

She initially bought a certified preowned car to make deliveries, but it came with even more debt. Leslie used her early DoorDash earnings to eliminate her car loan, then began throwing the rest at her remaining student loan balance.

The amount she earns each year depends on how many hours she worked. When she began in 2018, she earned around $6,324. By the next year, she had more than doubled her earnings to nearly $18,000.

Leslie usually makes deliveries after work on weekdays, and enjoys being able to use the flexible hours to her advantage. At one point, she was working an average of 30 hours a week through DoorDash in addition to her full-time job. Currently, she only spends about five hours a week on the side hustle.

DON'T MISS: The ultimate guide to earning passive income online

But Leslie's hard work has paid off. As of 2024, she has whittled down her remaining balance to around $18,000.

"It was really important that I got a lot of my student loan debt taken care of because then I was able to dedicate that back into myself and my health and my mental wellness," she says.

Living without a car in Houston

By 2023, Leslie's car was experiencing significant mechanical issues. One night, it almost caused her to be stranded while making a delivery.

Leslie decided to sell it and use the money to buy an electric bike, which she now uses to get to work and make deliveries.

"I intentionally did not decide to buy a new car," she says. "I had pretty much covered a lot of my debt that I wanted to pay off anyways, so it was a really great time to just kind of move on and not have a car."

Plus, she says not having a car saves her money due to not needing to pay for parking, car insurance and other related expenses.

"Getting around Houston has been actually pretty easy," she says. "When I'm going to the grocery store, for example, I can put all my groceries in my saddlebags and that kind of takes care of everything. It's also really great to use the metro rail line."

How she spends her money

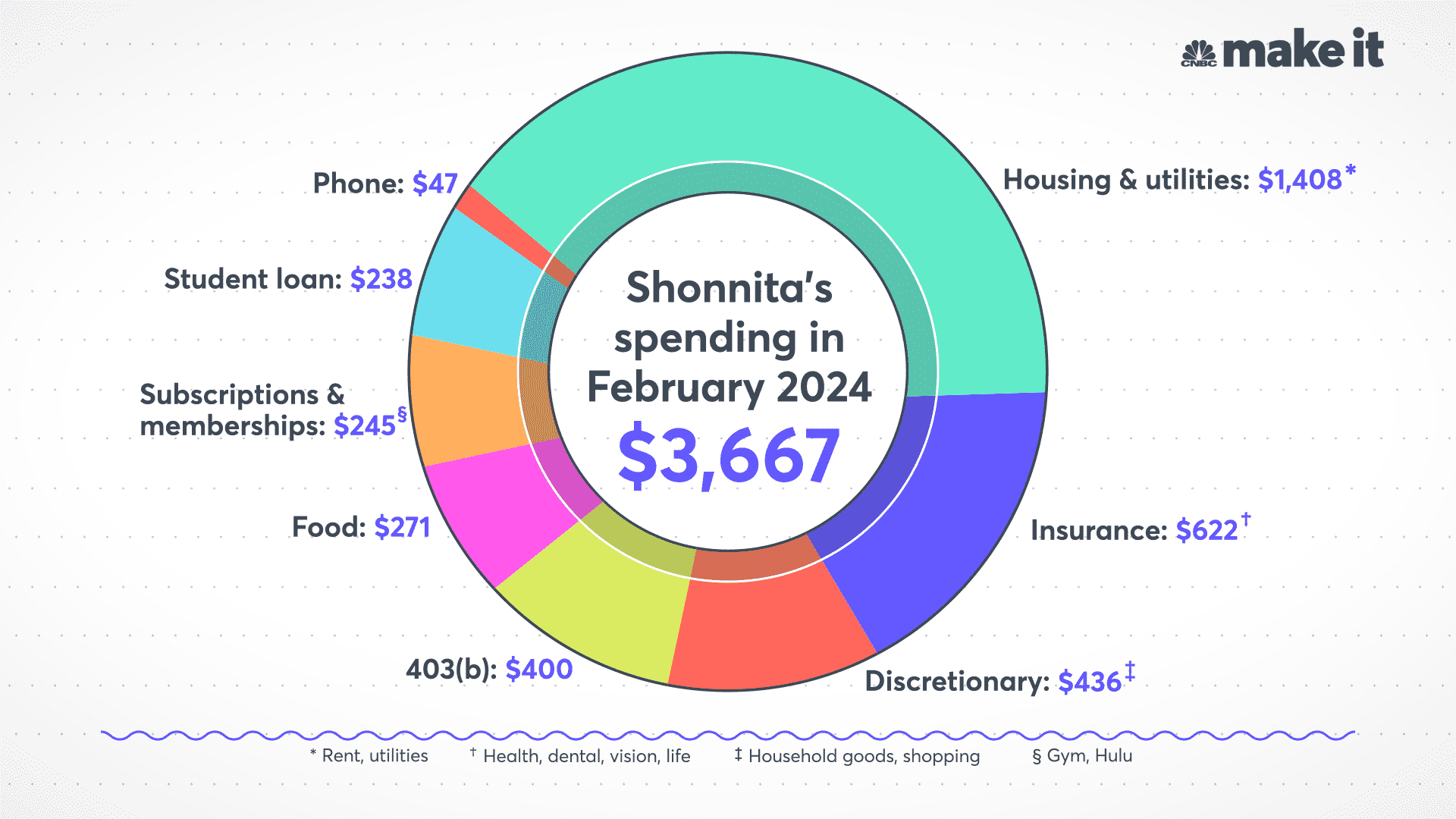

Here's how Leslie spent her money in February 2024.

- Housing and utilities: $1,408 for rent on a loft apartment, heat, water, electricity and Wi-Fi

- Insurance: $622 on health, dental and vision insurance

- Discretionary: $436 on household goods and shopping

- Retirement savings: $400 toward 403(b)

- Food: $271 on dining out and groceries

- Subscriptions and memberships: $245 on her gym membership and Hulu subscription

- Student loan repayment: $238 toward her remaining private student loan balance

- Phone: $47 for her phone bill

Leslie uses the zero-sum budgeting strategy to manage her money, which means she assigns every dollar of her paycheck toward her various expenses.

"I allocate every single dollar until it hits zero so that I understand where every expense came from," she says.

She makes sure to factor splurges into her budget as well, such as buying workout clothing from GymShark.

"Even if you're still paying off debt, you still have to have some level of a lifestyle," she says. "I do enjoy making sure that I have proper workout clothes and like to make sure I'm looking presentable."

One financial tool Leslie doesn't use is credit cards. Although when used responsibly, credit cards can help you build up your credit score and earn perks like travel rewards, she wants to avoid taking on any more debt while she focuses on paying down her student loans.

"I could always get into more debt if I want more debt," she says. "In the meantime, my focus [is on] the debt that I currently have."

Leslie has around $1,000 in savings, which she says is enough to cover any unexpected expense that may arise. "I haven't really needed to build a larger emergency fund yet because my liabilities are so low at the moment and I have insurance," she says.

She also has around $96,000 saved for retirement between her 403(b) plan and Roth IRA.

Working toward a debt-free future

Although Leslie says her student loan debt is at a more manageable level, she plans to continue working part-time as a DoorDash delivery driver for now.

"I don't have to do it," she says. "I like having the appeal of having multiple streams of income."

She also started her own small business, Noir in Color, where she offers her freelance writing services on topics like personal finance and side hustle ideas.

She knows she'll eventually want to own a home that she could rent out. However, she says she prefers renting for now because it's cheaper. After she pays down her student loans, she plans to work on boosting her credit to qualify for the best terms on a mortgage.

"I felt it was also essential that I continue to rent for right now until I'm able to feel comfortable enough to want to take on a large amount of debt all over again," she says.

Ultimately, Leslie looks forward to one day clearing her debt and spending her time as she pleases.

"My version of the American dream is just to be debt-free and live life on my own terms," she says.

What's your budget breakdown? Share your story with us for a chance to be featured in a future installment.

Want to make extra money outside of your day job? Sign up for CNBC's new online course How to Earn Passive Income Online to learn about common passive income streams, tips to get started and real-life success stories. Register today and save 50% with discount code EARLYBIRD.

Plus, sign up for CNBC Make It's newsletter to get tips and tricks for success at work, with money and in life.